Most experts predict that a correction may occur in the short term, but the market still has a chance to surpass 1,300 points after the holiday.

Forecasting the scenario for the new trading week, experts gave a relatively cautious view on the trend of VN-Index before entering the holiday season. Most experts predicted that a short-term correction may occur, but the market still has a chance to surpass 1,300 points after the holiday season.

Fed rate cut expectations may already be priced in

While it is almost certain that the Fed will cut interest rates at its September meeting (which has already been priced in), the market's main concern now is the extent and intensity of the Fed's cuts later this year. The market is currently expecting the Fed to cut about 0.75-1 basis points of its policy rate between now and the end of the year.

In that context, domestic investors should be more cautious as positive information has been partly reflected in the market's recent impressive growth and the VN-Index is facing strong resistance at the 1,290-1,300 point range.

If the market corrects to the support zone around 1,255-1,260 points, it will open up opportunities to accumulate more stocks, prioritizing industries with prospects for improvement in the second half of 2024 such as banking, exports (textiles, seafood, wood products) and some specific real estate businesses that have recently had deep discounts.

VN-Index may fluctuate before surpassing 1,300 points

Mr. Bui Van Huy - Director of DSC Securities Branch assessed the world context positively because the FED's view on monetary policy has become clearer after the Jackson Hole Conference. The possibility that the FED will certainly lower interest rates at the September meeting (September 18) and the current issue of concern is only how many times to lower.

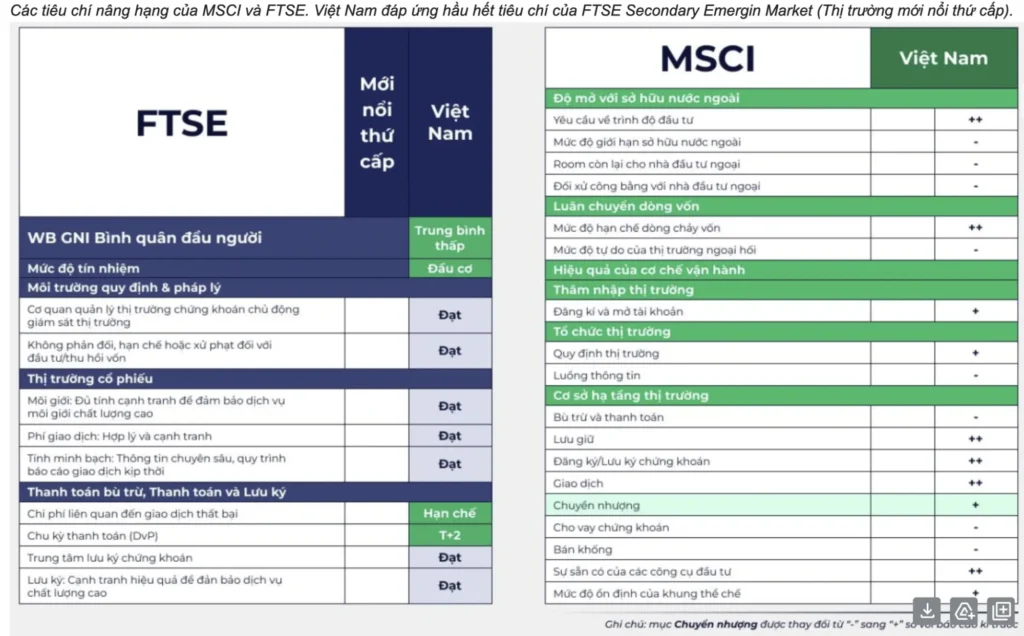

Another piece of information worth looking forward to is that FTSE will announce the list of national classifications at the end of September. The market is expecting new assessments from FTSE on Vietnam's upgrading process after many efforts by management agencies in the past time.

However, the upcoming 4-day September 2 holiday may have some impact on sentiment and liquidity will likely remain low around the holiday. Investors may take profits before the long holiday, but there is nothing to worry about.

Regarding investment strategy, experts believe that depending on each person's position, they can choose to take profit or disburse at this time. Therefore, the current stock ratio of 60-70% is suitable before the long holiday and the market approaches the resistance of 1,300. This helps investors be flexible in all situations, whether the market is rising or falling.

Take advantage of disbursement adjustment for medium and long-term goals

Although the index is unlikely to surpass 1,300 points in the short term due to cautious sentiment ahead of the holiday, lack of supportive information and investors tending to take profits after a period of good market growth, this is only a correction phase in a longer uptrend.

The market's medium-term uptrend is seen by experts as quite clear thanks to the strong recovery of the economy. Therefore, it is highly likely that the market will have an accumulation period before returning to the uptrend to conquer the 1,300 point mark.

In terms of investment strategy, long-term investors can take advantage of the current correction to accumulate stocks for medium and long-term positions. On the contrary, short-term investors should wait for the bottom signal and disburse again.

Source: CafeF