With a stable socio-economic situation, inflation always well controlled, combined with the market upgrade factor, it is very likely that the Fed's interest rate cut this time will not have a negative effect on the Vietnamese stock market.

The stock market is a mirror of the economy, but investors are always interested in the most prominent events that have a big impact on psychology and cash flow. The Fed's ability to start cutting interest rates in September 2024 after 3 years of maintaining a tight monetary policy is a historic event.

Will the US economy have a soft landing or fall into recession?

The foundation of the market economy (American capitalism) is based on Keynesian economic theory. Keynes was an economist born in the late 19th century. He founded the General Theory of Economics during the Great Depression of 1929-1931. Its foundation is based on Employment, Interest Rates and Money. Keynes also pointed out that effective demand will prevent recession. That is, supply is determined by demand. As long as demand increases, production and employment will increase, helping to keep the economy from falling into recession.

So what are the signs of an economic recession? There are 11 signs in total, but five are extremely important.

1. GDP declines continuously. According to modern economic theory, if the GDP (US) declines for 2 consecutive quarters, it is a sign of recession.

2. The labor market is suddenly weak. The most important of the employment data is the unemployment rate. If it goes above 5%, it is a danger sign. In addition, non-farm payrolls (hourly earnings decline) and new jobs are also signs of an impending recession.

3. The yield curve is inverted. If long-term interest rates are normally higher than short-term interest rates, but when they invert, it is a sign of economic decline.

4. Bad debt increases. Remember 2008 when the US banking system's bad debt increased dramatically, leading to a loss of liquidity, the famous bank Lehman Brothers went bankrupt, and real estate was sold off.

5. Conflicting fiscal and monetary policies between countries. When there is disagreement on interest rate management between major economies, it is a sign of an impending recession.

In addition to the five main causes above, there are other signs of economic recession such as weakened shipping, reduced oil demand, tightening credit conditions, geopolitical tensions, war, and epidemics.

The Role of the Fed

The Fed, also known as the US Federal Reserve, plays a role in formulating monetary policy and ensuring economic stability. The Fed will balance the risks between prices, the labor market and interest rates. Therefore, the Fed will proactively increase or decrease interest rates based on data on inflation and employment. Of course, the Fed will also have to act when it comes to emergency economic relief in times of crisis or recession.

Therefore, it is necessary to distinguish between two cases that are completely different in nature: one is that the Fed acts according to a roadmap, when it has achieved some goals such as inflation, for example, it will start to reduce interest rates. The other is that the Fed acts only because the economy is in recession or crisis. Therefore, just seeing the Fed reduce interest rates does not mean that the economy is weak and needs support.

When the Fed needs strong support, it always comes with coordinated measures like QE packages. QE essentially means pumping money from the Fed’s balance sheet. We have seen how quickly and how much the Fed has cut interest rates in previous cycles. Most of those emergency actions tend to instill fear in investors.

Is the (US) economy in recession?

As analyzed above, it is necessary to clearly distinguish between reducing interest rates according to a roadmap or reducing interest rates to urgently save the economy. If the economy is stable, but growth is slowing down, then reducing interest rates will have very little immediate impact. It only reacts strongly when the economy shows signs of danger.

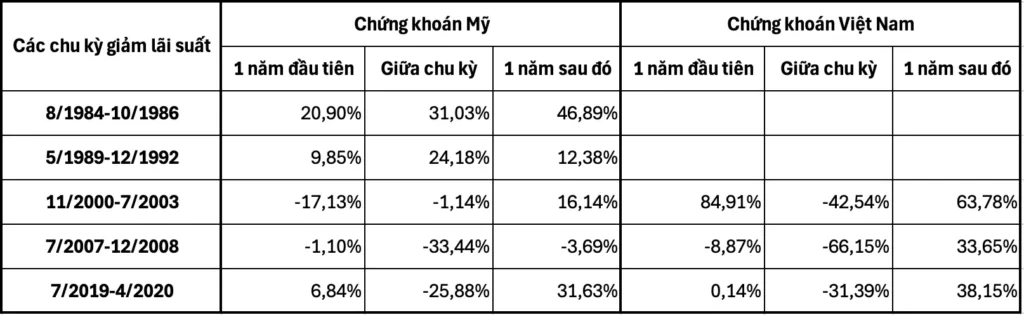

Analyzing the table above, we see that most of the time at the beginning of the cycle (1 year or 6 months), stocks have very little fluctuation. In the middle of the cycle, there is usually a relatively strong decrease. This may be the action of investors to take profits. And after the interest rate reduction cycle ends 1 year, stocks increase very strongly. That is the time to enjoy cheap money.

In the current context, it is difficult to say whether the (US) economy will fall into recession or not. The probability of a soft landing has also been mentioned many times by Fed officials and scholars. Lowering interest rates has positive points that everyone can see right away: it weakens the dollar, promoting money flow away from overly safe channels to shift to riskier investment channels such as Bonds and Stocks.

Vietnam's economy is a highly open economy. The impacts from the world economy, especially the US, always affect us. In the previous period, we witnessed the pressure of high exchange rates due to the high DXY, this pressure was also one of the reasons for the continuous net withdrawal of foreign capital.

Source: CafeF