Domestic stocks have just had an impressive trading week with 4/5 sessions increasing. VN-Index is heading towards the old peak of 1,300 points, market sentiment has become more cautious.

The market maintained an upward trend last week.

The market maintained an upward trend last week, with the VN-Index continuously surpassing the 1,260 and 1,270 point marks, thereby approaching the strong resistance zone of 1,290 - 1,300 points. However, the upward momentum showed signs of slowing down in the last two sessions of the week before the above strong resistance level, as well as waiting for the updated information of the Chairman of the US Federal Reserve (Fed) on monetary policy in the coming period.

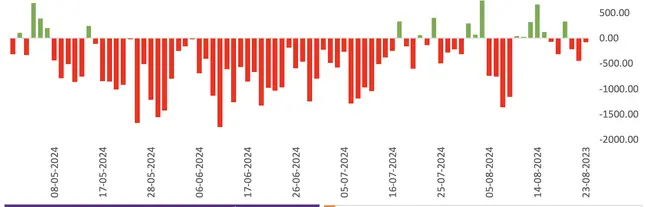

At the end of the week, VN-Index increased by 2.6% to 1,285.3 points. The banking groups VCB (+4.9%), BID (+6.3%) and CTG (+7.5%) were the main factors supporting the market. Liquidity increased by 19% to VND17,756 billion/session. Foreign investors net sold VND963 billion on all 3 exchanges.

According to observations by experts from VPBank Securities (VPBankS), the market has increased again but is in a state of "green on the outside, red on the inside". Cash flow is only focused on pillar stocks such as steel and banking. At the end of the week, even when the VN-Index was pulled up by pillar stocks, the number of stocks that decreased was still greater than the number that increased. Technically, the VN-Index encountered resistance at the 1,290 - 1,300 point threshold, increasing profit-taking pressure could also be a signal of technical correction.

Accordingly, investors can take partial profits from stocks that have increased strongly and restructure their portfolios to stocks that have not increased much to anticipate the cash flow in the coming weeks.

VNDirect Securities' analysis team commented:

VNDirect Securities' analysis team commented that the market's current major concern is the level and intensity of the Fed's interest rate cuts in the final stages of this year. The market currently expects the Fed to cut its operating interest rate by about 0.75-1% from now until the end of the year. However, if the Fed proposes a more cautious plan, it could impact and adjust investors' and market's expectations.

In that context, domestic investors should be more cautious, as positive information has partly reflected the recent impressive increase. VN-Index is facing strong resistance at the 1,290 - 1,300 point range. Investors should limit new disbursements with stocks that have recovered strongly in this range, maintain a moderate stock portfolio and limit the use of high leverage to manage risks.

“If the market corrects to the support zone around 1,255-1,260 points, it will open up opportunities to accumulate more stocks, prioritizing industries with prospects for improvement in the second half of 2024 such as banking, exports (textiles, seafood, wood products) and some specific real estate businesses that have recently had deep discounts,” VNDirect recommended.

VN-Index heads towards old peak of 1,300 points

With the VN-Index heading towards the old peak of 1,300 points, many comments said that the market in the short term has ended its downtrend to return to a positive accumulation channel in the 1,250 - 1,300 point range. It is forecasted that the VN-Index will continue to move towards the old peak of 1,280 - 1,300 points.

BIDV Securities (BSC) forecasts 3 scenarios for VN-Index in 2024. In the negative scenario, VN-Index approaches 1,200 points. In the baseline scenario, VN-Index will reach 1,298 points. In the positive scenario, VN-Index aims for 1,425 points.

BSC assessed that with the exchange rate pressure expected to cool down as the Fed cuts interest rates, corporate profit growth in the second half of the year will continue to be supported mainly by lower interest expenses, reduced exchange rate losses, reduced sales and business management costs, along with the low base level of the third quarter of last year.

Source: CafeF