SHS expects VN-Index to continue to move towards a very strong resistance zone around 1,300 points, possibly expanding to the 1,320 point zone corresponding to the highest price zone in June 2022.

VN-Index mainly fluctuated around the reference zone before closing the session on August 22, down slightly by 1.27 points to 1,282.78 points. Liquidity on all 3 floors reached nearly 17,400 billion VND, down 25% compared to the previous session.

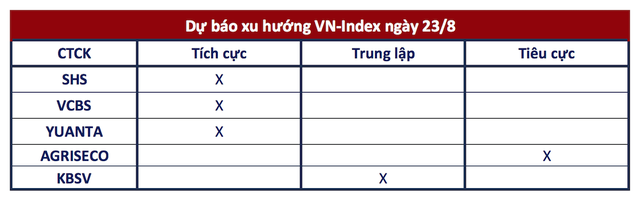

With a slight correction session, most securities companies believe that the correction phase may end quickly, and the VN-Index will move forward to conquer the next resistance levels.

Move up to resistance 1.300

In the short term, VN-Index is maintaining in the price range of 1,280 points - 1,300 points, the nearest support zone is around 1,280 points, stronger support is 1,255 points - 1,260 points. This is a very strong resistance zone that after many times aiming at in March, June and July 2024, it has been under strong correction pressure. The positive point is that the market has been recovering and increasing points in groups of codes, leading to many short-term buying positions with the potential to be profitable.

SHS expects VN-Index to continue to move towards a very strong resistance zone around 1,300 points, possibly expanding to the 1,320 point zone corresponding to the highest price zone in June 2022.

The shaking rhythm is necessary to go up

The market is still moving well and tends to be stable, fluctuations, adjustments and accumulation are normal in the upward process.

Investors are optimistic

The market may soon return to an upward trend in the next session. At the same time, the market is still in a period of strong fluctuations in a positive direction, so the correction may end quickly, and the cash flow has not shown signs of weakening even though the market is approaching short-term resistance zones.

In addition, the stock groups increased one after another. If the large-cap stock group grew in the previous sessions, the Midcaps and Smallcaps groups also showed signs of attracting cash flow again. The sentiment indicator continued to increase strongly, showing that investors are more optimistic about market developments and short-term risks remain low.

Testing selling pressure around 1.270-1.290

Agriseco Research believes that the adjustment and re-examination of supply and demand at important levels is necessary after the market has experienced a period of continuous rapid growth. Regarding the index's development in the coming period, the market may continue to test selling pressure around the 1,270-1,290 point range.

Investors can reduce the proportion of T+ trading positions in the early recovery phases. Investors should consider opening new buy positions again when the market has confirmed the balance zone, prioritizing oil and gas, real estate, securities, and retail groups.

Short-term correction signals may appear stronger

Profit-taking cash flow has appeared more clearly in some leading stock groups in the recent period, however, selling pressure has not increased dramatically and there is still demand to support prices, showing that the psychological trend is somewhat leaning towards a positive direction. Although the short-term correction signal may appear stronger, with the current upward momentum, VN-Index will have many opportunities to conquer the resistance level around 1300.

Source: CafeF