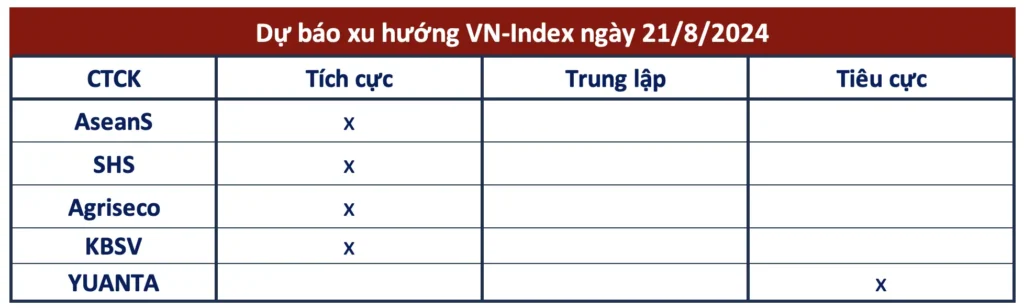

Yuanta recommends that investors limit chasing and prioritize buying during corrections because the market is likely to correct when the VN-Index trades near the resistance zone of 1,273 points.

Stock market opens on August 20

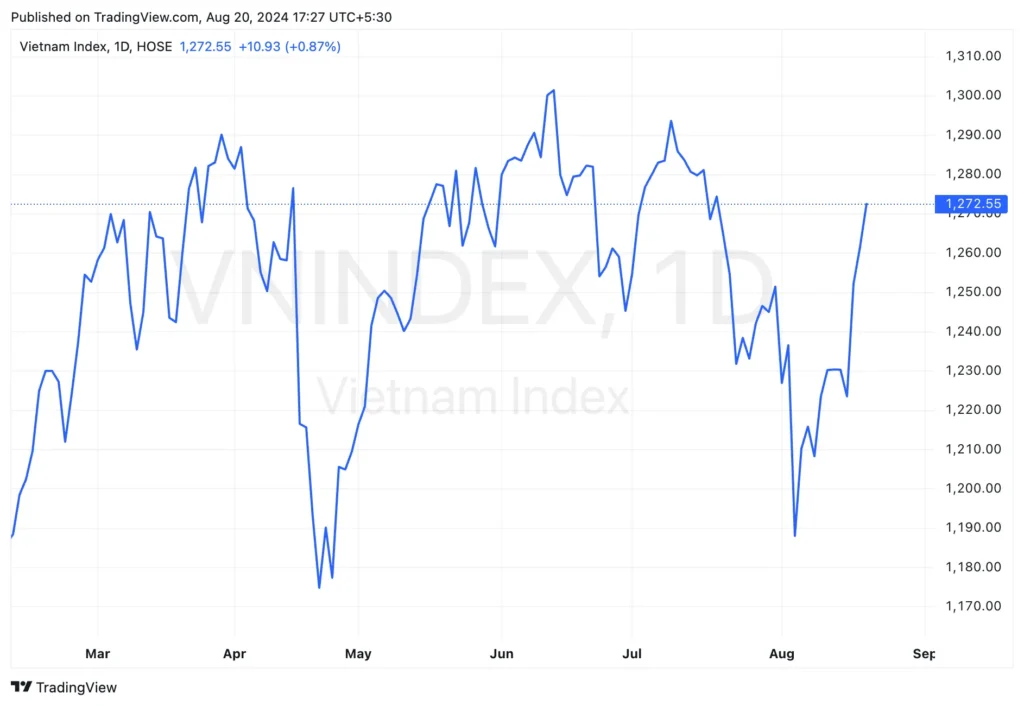

After a strong increase at the beginning of the week, the stock market opened on August 20 with a good increase to 1,275 points. Real estate stocks became the focus thanks to attracting cash flow, many codes even increased to the ceiling with no selling side. The increase narrowed slightly towards the end of the session, thereby VN-Index recorded an increase of nearly 11 points to close at 1,272.55 points. Foreign transactions were a plus point when they reversed to net buy with a value of nearly 313 billion VND across the market.

With another good increase, most securities companies predict that VN-Index will continue to increase before facing correction pressure at the strong resistance zone. However, investors are advised not to chase the market, prioritize holding on to their results and only disburse during fluctuations.

According to SHS Securities

According to SHS Securities, VN-Index in the short term has ended its downtrend to return to a positive accumulation channel in the 1,250 - 1,300 point range. The positive point is the pressure of low-priced stocks supply, low T+2 to account, leading to many buying positions with good profit potential. SHS expects that under the influence of the recovery of stock groups, VN-Index will continue to move towards the price range of 1,280 -1,300 points.

However, SHS recommends that investors should not buy immediately because this is not an attractive price range and the index is susceptible to strong correction pressure. The disbursement target is leading stocks with good growth in Q2 business results and positive prospects for the end of the year.

According to Asean Securities

Same view, Asean Securities VN-Index is forecasted to continue to move towards the old peak (1,280 - 1,300 points). The tug-of-war process will take place when profit-taking pressure and cautious psychology increase and may continue to break out when confirming the signals of consolidating the price base in this area. Investors should maintain their achievements, possibly restructuring their portfolios into groups with stocks with price strength and positive business information in the short term.

According to KB Securities Vietnam

KB Securities Vietnam The cash flow into leading stocks is still showing excitement, creating the main support for the market. It is likely that VN-Index in the next session can continue to maintain its recovery momentum before facing pressure to shake and adjust more strongly around the upper limit of the near resistance zone. Investors are recommended to buy pillows when the general market or target stocks adjust to the near support zones.

According to Yuanta Vietnam Securities

Take a more cautious view, Yuanta Securities Vietnam believes that the market may correct in the next session with the nearest support zone at 1,260 points. However, the market is still in a period of strong fluctuations in a positive direction, so the correction may also end quickly, mainly of a technical nature with increased profit-taking pressure when many stocks have reached high profits from the short-term bottom.

New buying opportunities continue to increase. Yuanta recommends investors to limit chasing and prioritize buying during the correction phase because the market is likely to correct when the VN-Index trades near the resistance zone of 1,273 points.

Source: CafeF