In the context of Asian stocks recovering after a sharp crash at the beginning of the week, VN-Index on August 6 also successfully conquered the 1,200 point threshold. Bottom-fishing demand joined in, spreading green.

Although it has not been able to recover all the losses in the session of August 5, the recovery of VN-Index has somewhat relieved the psychological pressure on investors. There is no longer a scene of panic selling, domestic stocks reacted positively right at the opening hour, immediately increasing by 12 points after the ATO session, returning to the threshold of 1,200 points.

However, the market was once again challenged in the morning session, the 1,200 point mark could not be maintained at many times.

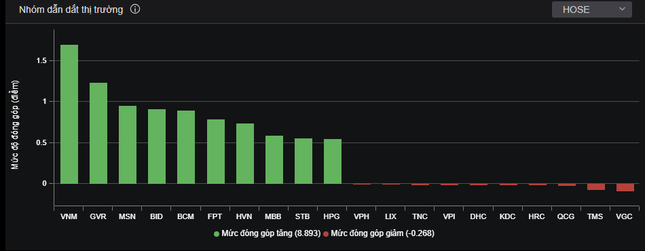

After the lunch break, many stocks extended their gains, green covered the whole area, VN-Index once again conquered the psychological mark of 1,200 points. The VN30 basket had 28/30 stocks increasing in price, with VNM leading the market, closing at 4.8%. A series of large stocks increased by 3-5%, adding more traction to the main indices.

Many sectors recorded better performance than the market recovery, notably securities. More than 20 stocks increased in price, BSI hit the ceiling. Cash flow was directed to SSI, VIX, SHS, VND, HCM, FTS, VCI, MBS... FTS closed close to the ceiling price.

Some small codes also recorded good growth, closing at the ceiling price such as HNG, DLG, LDG... HBC of Hoa Binh Construction increased by 5.6%, recording bottom-fishing demand to "rescue" after information that Mr. Le Viet Hai's brother registered to buy 500,000 shares.

At the end of the trading session, VN-Index increased by 22.21 points (1,87%) to 1,210.28 points. HNX-Index increased by 3.75 points (1,68%) to 226.46 points. UPCoM-Index increased by 1.43 points (1,58%) to 92.22 points. Liquidity decreased sharply compared to the previous session, down to VND13,800 billion. Foreign investors net sold VND756 billion, focusing on VJC, FPT, AGG, MWG.

Today, Asian stocks also recorded a broad recovery, notably the Japanese market when the Nikkei 225 ended the session on August 6 up 10.23% to 34,675 points. The Topix also increased 9.3% to 2,434.21 points. South Korea's Kospi index rose above 3%, while the small-cap Kosdaq increased over 5%.

Mr. Barry Weisblatt David - Director of Analysis, VNDirect Securities - commented that yesterday's trading session created a good buying opportunity, predicting that the market outlook at the end of 2024 will improve.

The Bank of Japan’s (BOJ) decision to raise interest rates has had little impact on Vietnam. Japan is only Vietnam’s sixth-largest export market. Most of Japan’s investment in Vietnam is in the form of development assistance (between governments) or long-term FDI, such as SMBC’s $1.5 billion investment in VPBank.

These flows are not inherently sensitive to moderate currency movements in the same way that ETF flows would be.

“Slower US growth could put some pressure on export forecasts (as the US is Vietnam’s largest export market). Meanwhile, manufacturing activity remained strong in July.

PMI (purchasing managers index) reached 54.7 points thanks to a strong increase in new orders. In a positive scenario, VN-Index closing above 1,400 points in 2024, corresponding to a P/E (price to earnings ratio) of 14.8x is currently feasible,” said Mr. Barry.

Source: CafeF