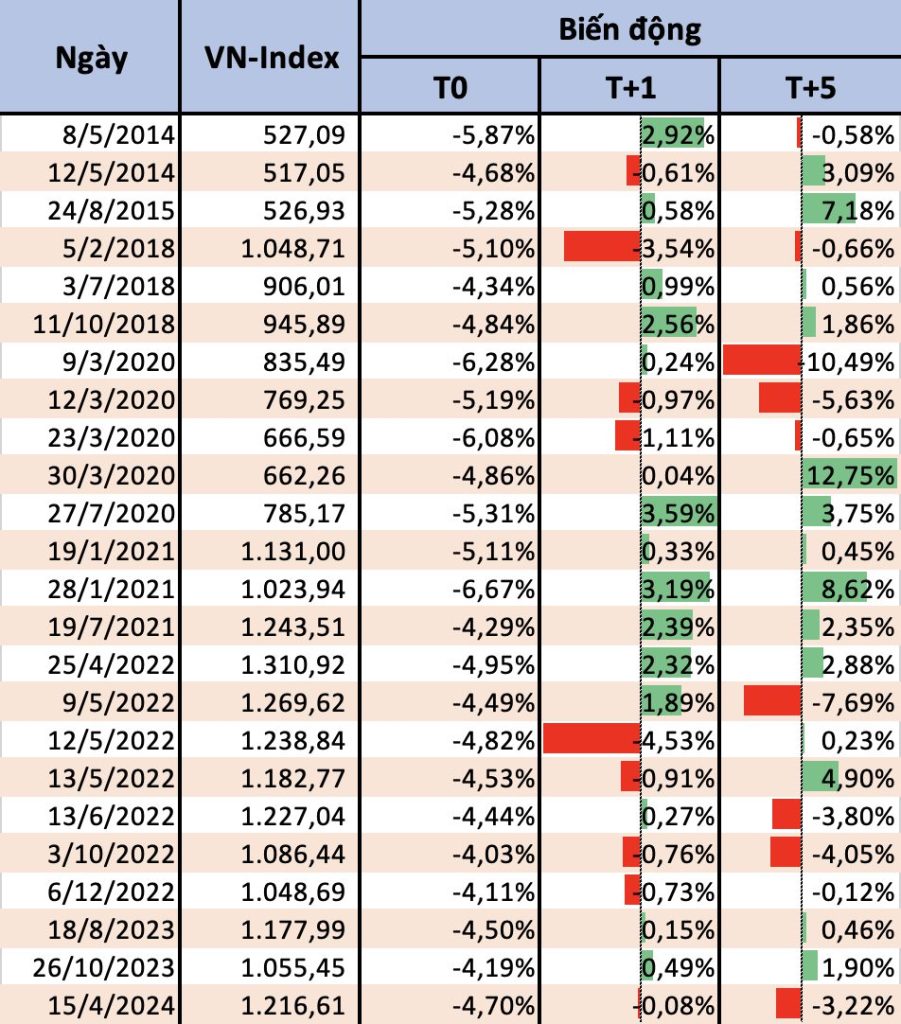

Since the HoSE amplitude returned to +/-7% in early 2013, the VN-Index has fallen by more than 4% in a session 24 times. The speed of recovery of the Vietnamese stock market after recent falls depends largely on the timing of the events.

Sharing the same fate as global stocks, the Vietnamese stock market has just experienced a turbulent trading session. The VN-Index dropped nearly 50 points to below 1,200 points, the lowest in more than 3 months.

The figure of approximately 4% is also the second sharpest decline of VN-Index since the beginning of the year, only after the session on April 15 when the index lost 60 points (-4.7%).

In the past, Vietnamese stocks have experienced many volatile sessions with the VN-Index's decline even deeper than the August 5 session.

Since the HoSE amplitude returned to +/-7% in early 2013, the VN-Index has decreased by more than 4% in a session 24 times, mostly concentrated in the 2020-2022 period, after Covid cast a shadow over the global financial market.

It can be seen that Vietnamese stocks often recover quite quickly after deep falls. According to statistics, VN-Index has increased 15/24 times right after a session of more than 4%, corresponding to a probability of 62.5%. If looking at a longer time frame, VN-Index also increased 14/24 times in the trading week (5 sessions) right after a sharp decline.

From 2020 to mid-2022, with the cash flow from a wave of new investors constantly pouring into the market, the VN-Index showed the ability to recover quite quickly after each slip. During this period, the index often rebounded quite strongly in the next session and trading week right after the deep decline.

The situation changed in the second half of 2022 when the stock market was hit by storms. The VN-Index even fell more than 4% in two consecutive sessions on May 12-13, 2022. The recovery trend quickly returned in 2023 when the VN-Index increased again in the next session and the week after falling deeply.

In fact, the speed at which the market recovers from recent falls depends a lot on when they happen.

Typically, during the sharpest decline since the beginning of the year, the VN-Index was anchored around the long-term peak and had just begun to correct. As a result, the index lost another 0.08% in the following session and continued to be blown away by 3.22% in the week after the slip.

At present, the market has adjusted relatively compared to the most recent peak with a decrease of more than 100 points (about 8%). Therefore, some factors such as profit-taking pressure, margin, ... may be somewhat less stressful.

However, there are still potential risks that are difficult to assess, such as geopolitical tensions in the Middle East and Japan's sudden policy reversal.

After Asian stocks fell sharply on August 5, especially in Japan, it was the other half of the world's stock market's turn to suffer a sell-off.

US stocks were in the red with the Dow Jones, S&P 500 and Nasdaq all falling sharply. Europe was no exception as the FTSE 100 and DAX both fell sharply. This had a definite impact on the sentiment of stock investors in Vietnam.

In general, historical data is for reference only due to the different contexts of each period. It is very difficult to accurately predict the fluctuations of the stock market in the coming sessions.

Short-term pressure is clearly inevitable. However, there are still positive factors for investors to look forward to.

According to Mr. Nguyen The Minh - Director of Yuanta Vietnam Securities Analysis, looking back at market valuations, the times when VN-Index reached the 1,200 point mark, the market's P/E fell to around 10 times.

History shows that when P/E falls to 10x, it is likely a market bottom. Furthermore, the fundamental story of the company is much more attractive. Although the downward pressure is still there, the current risk is much lower than the market's upside opportunity.

Yuanta experts expect that the market will soon regain the 1,200 point mark in the next few sessions.

In addition, the current stock yield is approximately 9%/year while the savings interest rate is 5.5-6%/year. Investors are seeing the market as quite bad and are afraid, following the crowd effect, but will soon return, so the cash flow will soon improve.

Sharing the same view, Mr. Bui Van Huy - Director of DSC Securities Branch assessed that the market may retest MA200 around 1,200 points but will maintain and recover as what happened last weekend.

It is difficult to expect excitement but perhaps we should not be pessimistic. The second quarter results season has passed but will be a good reference to predict the recovery of corporate profits in the final period of the year. Thanks to that, this is the time to think long-term.

Source: CafeF