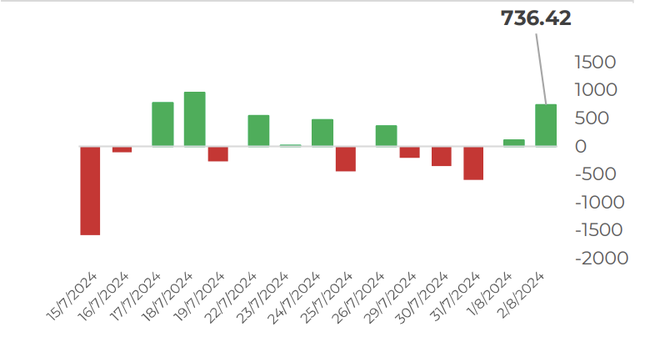

VN-Index experienced a volatile trading week, at times falling to nearly 1,210 points. Self-employed and foreign investors took advantage of the opportunity to buy stocks while the market was adjusting. After the peak of financial reports, the market fell into an information "trough". Will there be enough force to pull VN-Index to continue its recovery momentum next week?

From the old peak, the main index corrected nearly 100 points before recovering broadly at the end of the week. Liquidity increased with HoSE order matching value increasing nearly 9% during the week.

Along with the appearance of bottom-fishing cash flow, foreign investors also steadfastly "collected goods" despite the market correction. On August 2, foreign investors net bought nearly 595 billion VND in the whole market, focusing on VNM, DGC, HPG...

The industry group that actively contributed to the recovery of VN-Index was food and beverage, typically VNM increased by more than 8% in the week of market correction. Oil and gas stocks reacted to the Middle East tension between Iran and Israel with green from BSR, PVC, OIL stocks. The banking group contributed positively to VN-Index with VPB, TCB, SSB, NAB, BID, VCB increasing in price.

The analysis team of Saigon - Hanoi Securities commented that the short-term trend of VN-Index is still negative, after failing to test the resistance zone around 1,255 points.

However, in the last 2 sessions of the week, many stocks that were under strong selling pressure have recovered well, especially stocks with good fundamentals and good growth in Q2 business results. This shows that the strong fluctuations in these 2 sessions have many short-term characteristics of shaking off speculative positions, high leverage... opening up positions to accumulate good quality stocks.

In the short term, according to SHS, the market started August with a gap in corporate information after the second quarter reports were released. Therefore, the market will depend largely on the growth prospects of large-cap companies and GDP growth.

Short- and medium-term investors should maintain a reasonable, average weight and consider restructuring to reduce the weight of stocks with business results in the second quarter of 2024 that are not as expected, or that violate the stop-loss level if any, to restructure to leading enterprises with good fundamentals and good business growth results, exceeding expectations.

“New positions can consider disbursing at reasonable prices for leading enterprises with good fundamentals, based on second quarter growth results and expectations of good growth at the end of the year,” SHS experts recommended.

Experts from Asean Securities said that the positive recovery at the end of the week with strong buying power at the end of the session has spread the sentiment to help the general market improve. Moderate liquidity is not too large, showing that buying power is still cautious and only locally expressed in a few stocks. The overwhelming buying movement helps VN-Index increase the probability of forming a second bottom.

However, the rapid and strong recovery at the end of the session cannot be fully reflected in the context that the market has not officially bottomed and T+ demand may appear in the next trading session. Investors should avoid chasing and only buy back during market corrections, if the bottom is established next week.

This August, Nhat Viet Securities' analysis team forecasts two scenarios for the VN-Index. Scenario 1, with weakening pressure and active low-price demand in the 1,200-1,230 point range, the VN-Index may continue its sideways movement within the 1,200-1,300 point range.

In the remaining scenario, if VN-Index breaks through the support zone of 1,200 - 1,230 points, the risk of a deep correction in the market will be confirmed. The main index may have to seek balance at lower price zones.

Source: Cafef