Just one more misstep and Vietnamese investors will see the familiar number 1,200 appear again.

VN-Index heading towards 1,200 points in a downward direction is an undesirable scenario but is appearing before the eyes of Vietnamese stock investors. After dropping nearly 2% in the last session, the index is less than 27 points away from the "haunting" 1,200 mark. Just one more misstep, and investors will see this familiar number again.

This is a disappointing result as many investors had previously expected the VN-Index to surpass 1,300 points, with some even making bolder predictions. Many securities companies believe that the index could reach 1,400-1,500 points by the end of the year. More optimistically, foreign fund Pyn Elite Fund also predicted that the figure could reach 1,700 points.

Many arguments were put forward by the parties to defend the project, including:

(1) The Fed's move closer to a rate cut decision helps reduce exchange rate pressure;

(2) Corporate profit growth is still highly appreciated and in fact, the second quarter figures also have many bright spots;

(3) the efforts of the regulatory authority and market participants in the upgrading process.

It is too early to confirm whether the above comments are offside or not, but the fact that VN-Index repeatedly failed before the threshold of 1,300 and then retreated to the 1,200 point area has somewhat disappointed investors. In fact, the number 1,200 is an obsession that has haunted Vietnamese stock traders for many years.

In the past, VN-Index was very close to the 1,200 point mark in March 2007. At that time, Vietnam's stock market was still in its infancy, the number of listed stocks was small with 107 codes and was easily "over-inflated". According to the International Monetary Fund (IMF), the P/E of VN-Index was even up to 73 times.

On the contrary, VN-Index often stays below the 1,200 point mark for quite a long time. The period often lasts for many months, even years. The longest period is from the first time it officially surpassed 1,200 in early April 2018 to early April 2021, meaning it took 3 years for Vietnamese "stock traders" to see this mark again.

Overall, the past 3 months can be considered a “long dream” for Vietnamese stock traders. If the “nightmare” of 1,200 points comes and brings everything back to reality, it will not be too surprising because it has happened so many times.

The lack of new "goods" on the market, and not even having many quality options, is what makes long-term money not interested in the market.

Equitization and divestment activities are gloomy and the waiting list does not have many real “blockbuster” names. The most powerful “reserve” team for listing is the giants currently trading on UPCoM such as ACV, VGI, BSR, MVN, etc.

However, this group has some problems in the floor transfer process that cannot be easily solved overnight.

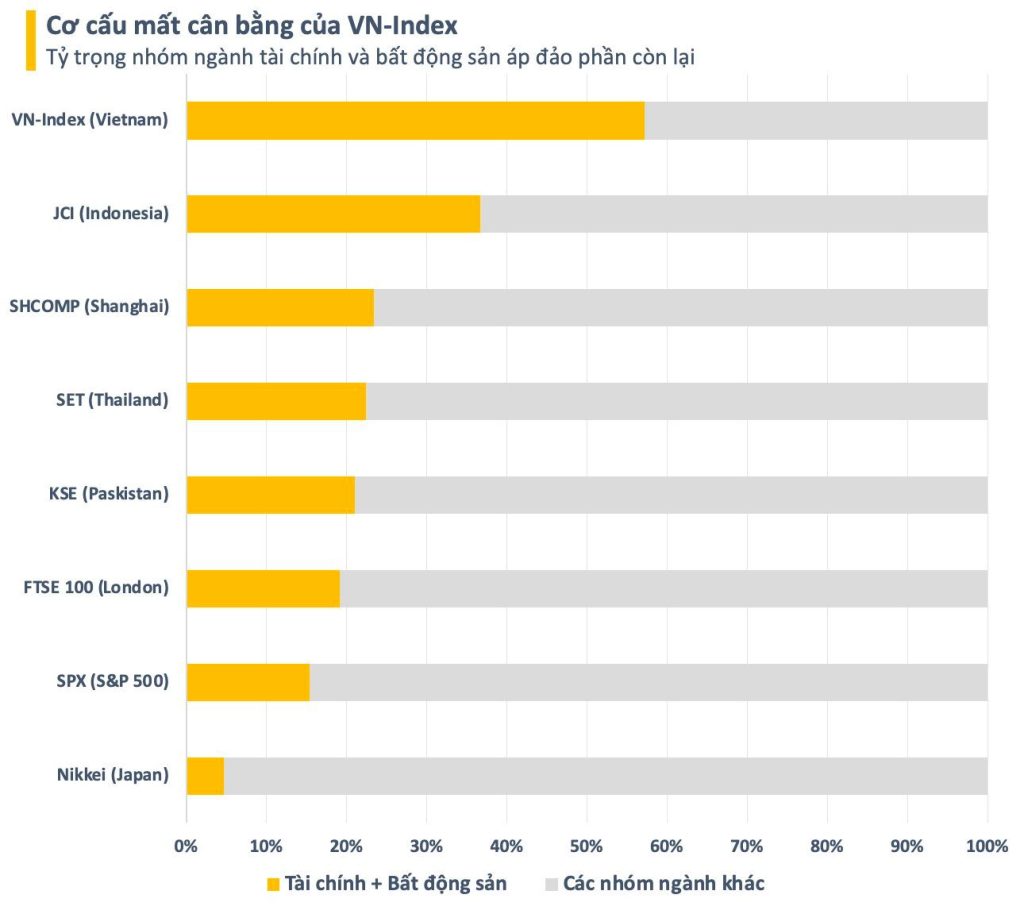

It is undeniable that the structure of the Vietnamese stock market is changing towards greater diversity in terms of industries and sectors. However, the financial and real estate “framework” is still overwhelming and this situation will continue in the short term.

This change process requires a lot of time for new faces to rise up to replace the old Bluechips.

This imbalance is one of the major barriers to long-term capital flows into Vietnamese stocks even if they are officially upgraded. Theoretically, Vietnamese stocks could receive tens of billions of dollars in foreign capital if they are upgraded from a frontier market to an emerging market.

However, the number of stocks that meet the criteria to be included in the portfolio of large-scale foreign funds specializing in investing in emerging markets is not much. On the contrary, funds specializing in investing in frontier markets will then sell a large amount of Vietnamese stocks, creating no small amount of pressure.

Source: CafeF