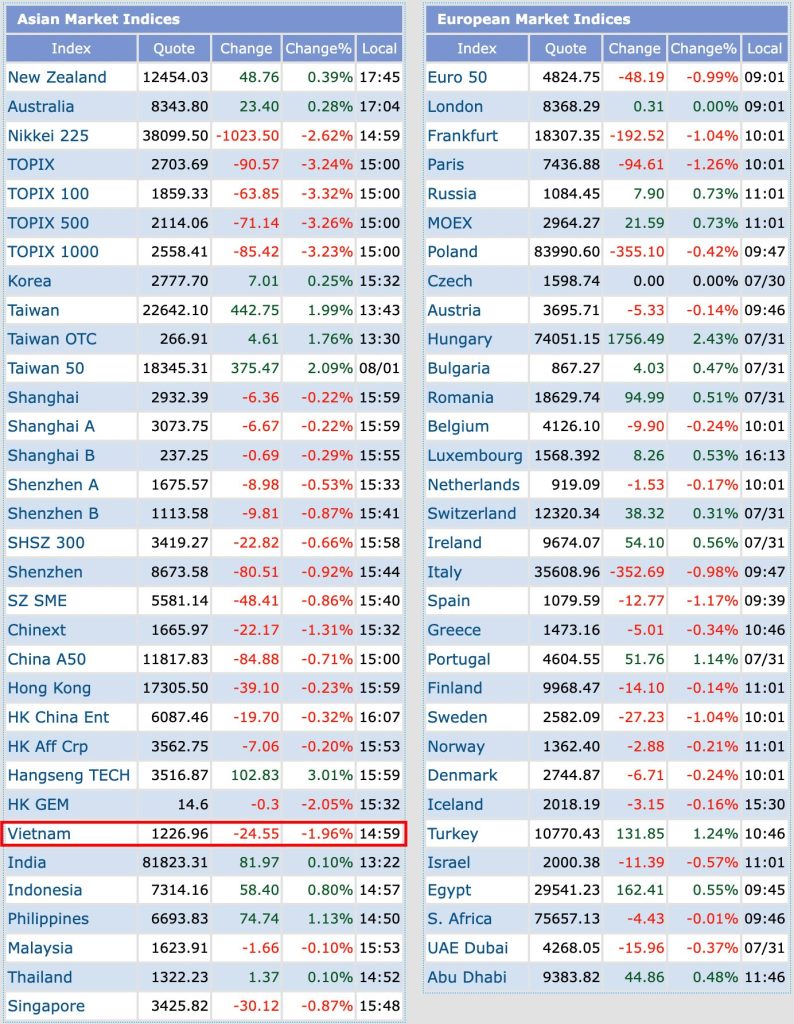

The decrease of nearly 2% made VN-Index lead the list of the world's "worst" stock indexes in the session of August 1.

Negative sentiment dominated the stock market in the first session of January 8, the market fell sharply and widened its decline towards the end of the session. The VN-Index at one point dropped nearly 30 points, close to the 1,220 mark under strong selling pressure that pushed hundreds of stocks to the floor.

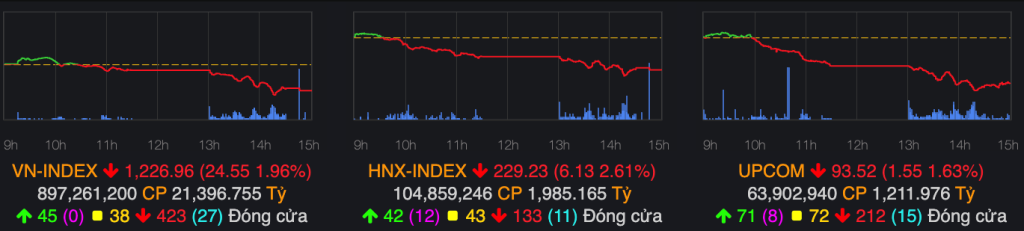

However, the demand was slightly activated when the index touched this threshold, helping the market recover, thereby narrowing the decline. VN-Index closed at 1,226.96 points, corresponding to a decrease of 24.55 points (-1.96%).

Liquidity improved compared to previous sessions with approximately 900 million shares traded on the HoSE, worth nearly VND21,400 billion.

Overall, 768 stocks fell across the market, of which 53 stocks fell by the full limit. Notably, the drop of nearly 2% made VN-Index lead the list of the “worst” stock indices in Asia in the session of August 1.

According to records, a series of large-cap stocks were sold off heavily in today's session. Up to 28/30 stocks in the VN30 basket decreased in points, of which 15 stocks fell deeply below 2%, even BCM hit the floor at 7%. On the contrary, only two banking stocks, VCB and SSB, recorded green, but their contribution to the market was not too significant.

Most real estate, securities, retail, technology stocks... are all in red, even LHG, VRE, EVF, LDG, CMG, NHA, DPG, PDR, NTL, CTS, VDS, ... hit the floor with "no buyers".

Banking shareholders also had an unhappy session when half of the 2% fell sharply, with "big guys" such as CTG, BID, MBB, TCB, VPB... all in red.

Negative developments were also recorded in steel stocks when TLH and SMC fell to their full range; HPG, HSG, NKG fell sharply. In the oil and gas group, only PVD, PVS and PGD remained green with a slight increase of %; the rest, BSR, OIL, PVB, PVS, POS... all decreased.

In terms of specific contributions, the bluechip duo GVR and FPT became the biggest "culprits" causing the VN-Index to lose a total of 2.8 points in the first session of the week. Specifically, GVR decreased by 4.8% to VND31,400/share, causing the VN-Index to decrease by nearly 1.5 points; FPT also had a strong correction of 3% to VND124,800/share, causing the VN-Index to decrease by nearly 1.33 points.

In addition, the floor price reduction made BCM a factor that weighed heavily on the market, taking away 1.2 points from the main index of the Vietnamese stock market.

The top 15 stocks that negatively impacted the VN-Index in this sharp decline also included bluechips such as MSN, HGP, VNM, MWG, GAS, SSI... In addition, some banking stocks were also in the group of stocks that negatively impacted the market today such as MBB, BID, VPB.

The market’s pillars such as “banks, steel stocks” and bluechips of manufacturing and technology groups have adjusted, causing the indices to rapidly plummet. In addition, demand is not really ready to return, causing the market to lose its support even more.

On the other hand, the glimmer of green in some stocks VCB, SSB, PNJ, NAB, DBC could not help the market avoid a sharp decline.

In fact, the market has not been able to break out yet, the constant selling pressure every time the main index approaches the resistance level makes the recovery scenario more difficult. The unclear trend of VN-Index has impacted investors, causing them to not have the motivation to increase disbursement in the current period.

One of the bright spots of the session/18 came from foreign investors when they recorded net buying in a session with a deep decline. However, the buying value was relatively low, insignificant compared to the continuous net selling momentum in recent times.

Most analysts at securities companies also maintain a relatively cautious view on market trends. KB Securities Vietnam (KBSV) in its last comment of the previous session said that short-term pressure will likely create more and more pressure only during the recovery process when the short-term downtrend is still being distributed.

KBSV recommends that investors should prioritize a defensive strategy, selling to a low level during an early recovery.

Similarly, Asean Securities assessed that the market momentum in the medium term is still weak and the Index has not yet completely bottomed out if it has not completely surpassed the 1,260 point mark. Therefore, AseanSe maintains the view that investors should avoid chasing green prices in the current context, temporarily hold a moderate proportion of stocks and observe the market.

Source: CafeF