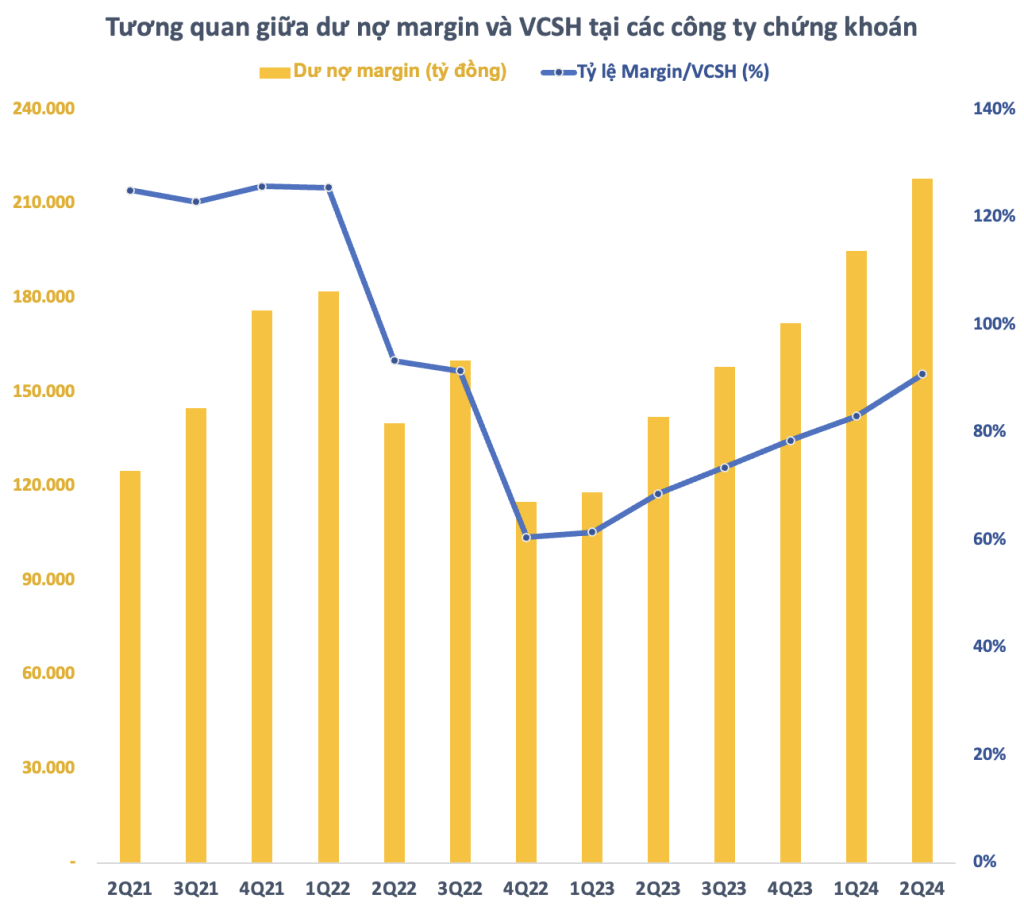

The Margin/Equity ratio at the end of the second quarter is estimated at approximately 90%, the highest in 7 quarters but still much lower than the period when VN-Index was above 1,500 points as well as the prescribed safety threshold (200%).

According to statistics, outstanding loans at securities companies at the end of the second quarter of 2024 continued to break records, estimated at about VND 225,000 billion, far exceeding the early period of 2022 when the VN-Index peaked at 1,500 points. Compared to the end of the first quarter, outstanding loans at securities companies as of June 30 are estimated to have increased by about VND 18,000 billion, thereby recording the 6th consecutive quarter of increase compared to the previous quarter.

Of which, the margin balance as of June 30 is estimated at around VND218,000 billion, an increase of VND23,000 billion compared to the end of the first quarter and also a record number in the history of Vietnam's securities market. However, the margin is not too tight as the equity of securities companies also increased after the second quarter, although the speed has slowed down due to the gradual decrease in capital raising activities.

As of June 30, 2024, the total equity of the securities company group is about VND 242,000 billion, an increase of about VND 7,000 billion compared to the beginning of the year. Correspondingly, the Margin/Equity ratio at the end of the second quarter is estimated at approximately 90%, the highest in 7 quarters. However, this figure is still much lower than the period when VN-Index peaked at 1,500 points.

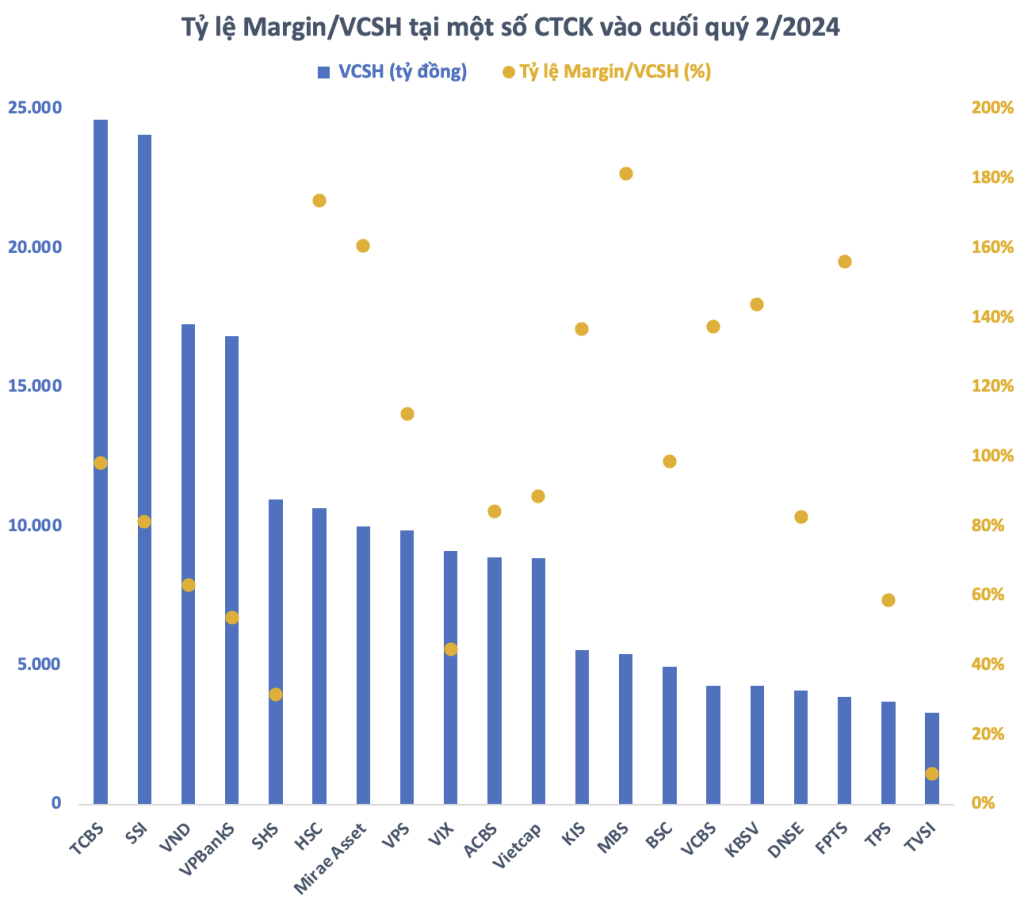

According to regulations, securities companies are not allowed to lend margin exceeding twice the owner's equity at the same time. With the current margin/equity ratio, securities companies estimate that there are still up to VND 266,000 billion that can be lent to investors on margin in the near future.

It should be noted that this figure is only a theoretical calculation and in reality, the total market Margin/Equity ratio has never reached the threshold of 2 times, even in the most explosive trading period. Furthermore, how much more margin an investor can borrow depends on the corresponding collateral (including cash and stocks).

Looking at each securities company, most of them still have a lot of room for lending, the Margin/Equity ratio is mainly below 100%. In particular, the top names in terms of equity such as SSI, VNDirect, VPBankS still have this ratio below 80%. Meanwhile, some securities companies are in a state of quite tight margin such as HSC, Mirae Asset, MBS, FPTS with this ratio at above 150%.

In general, if only serving margin lending activities, securities companies are not under too much pressure on capital at this time. However, to serve the process of upgrading the market, in the future, foreign investors may not need to deposit 100% before trading. This requires securities companies to have large capital resources, enough to ensure the role of supporting payments for foreign investors. Therefore, most securities companies have plans to increase capital in the period of 2024-25.

According to KBSV's summary in its recent strategic report, the group of observing securities companies expects to increase their total charter capital by more than VND 26,000 billion, equivalent to an increase of VND 23% compared to the first quarter of 2024 through issuance to existing shareholders, private issuance and ESOP. The newly increased capital will boost business activities, specifically: (1) increase resources for margin lending; (2) increase resources for investment; (3) invest in systems, technology and human resources.

Similarly, TPS's strategic report also stated that the margin purse from securities companies will be expanded in the second half of 2024 and 2025. The ratio of outstanding loans to Margin/Equity is still much lower than the prescribed safety level. It is expected that the amount of margin loans in the second half of this year will increase significantly when in the late 2023 and first half of 2024, a series of securities companies have approved strong capital increase plans such as ACBS, HSC, SSI, SHS, Vietcap, etc. This shows that the margin lending space in the coming time will be very large and will support the growth of the stock market.

According to TPS, the second half of 2024 will be the premise for the market's "uptrend" from (1) The story of market upgrading is brighter when MSCI's assessment report in June 2024 shows that Vietnam has improved the transferability criteria; (2) The KRX system is being urgently completed, expected to be deployed from September 2024, strengthening the market's ability to upgrade. (3) Important laws such as the Land Law, Real Estate Business Law, etc. Taking effect from the third quarter of 2024 will create momentum for the market to increase points.

Source: CafeF