The total size of 9 ETF funds currently referencing 3 indices VN30, VNDiamond and VNFIN Lead is approximately 23,000 billion VND.

HoSE has officially announced the results of the index portfolio review for the third quarter of 2024. The new indexes will take effect from August 5, 2024 and the related ETFs will restructure their portfolios with a deadline of August 2, 2024. SSI Securities (SSI Research) has just released an estimate of the index portfolio and transactions of related ETFs. According to estimates, the total size of the 9 ETFs currently referencing the 3 indices VN30, VNDiamond and VNFIN Lead is approximately VND 23,000 billion.

For the VN30 index basket, the portfolio has no changes in this review period. Among the ETFs on the market, there are currently 4 ETFs using the VN30 index as a reference, including DCVFMVN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF and MAFM VN30 ETF with total estimated assets of VND 9,300 billion as of July 15, 2024.

The DCVFMVN30 fund alone currently has a total asset value of about VND 7,400 billion as of July 15, 2024, down 1.61% compared to the beginning of 2024, NAV increased 161% and the fund has been net withdrawn by VND 1,300 billion since the beginning of the year.

According to SSI Research's estimates, ETF funds referencing the VN30 index may sell more than 1.6 million FPT shares and nearly 374 thousand MSN shares to reduce their portfolio weight. On the contrary, some stocks may be bought heavily to increase their weight, such as SSB (1.15 million shares), POW (922 thousand shares), VPB (911 thousand shares), TCB (876 thousand shares), ACB (769 thousand shares), etc.

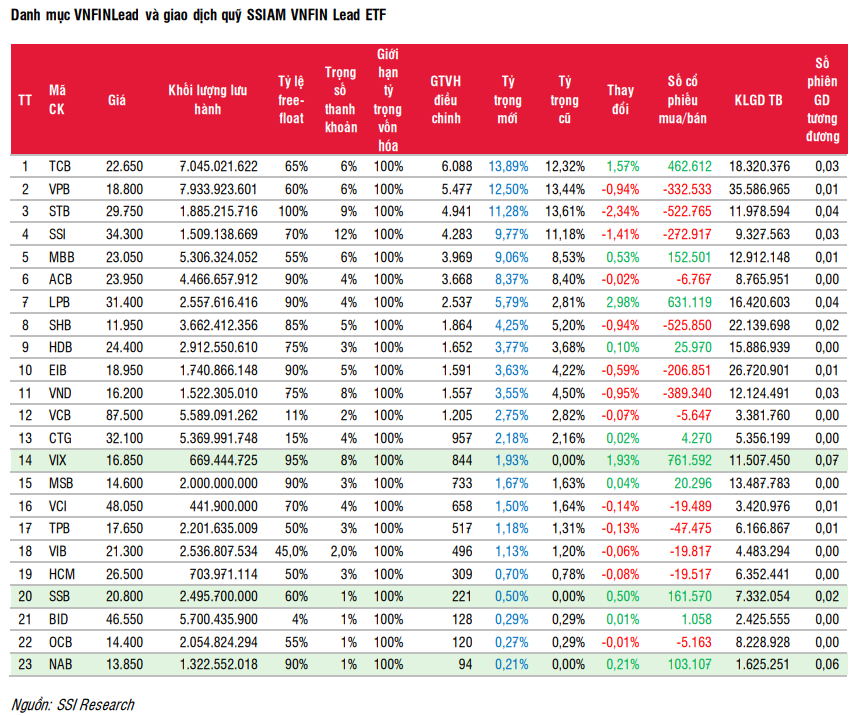

VNFIN Lead Index Basket adds VIX, SSB and NAB and excludes no stocks. The new index portfolio will include 23 stocks.

As of July 15, 2024, SSIAM VNFIN Lead ETF fund had a total asset value of about VND 665 billion, down 71.11% compared to the beginning of 2024. NAV increased 13.11% compared to the beginning of the year and the fund had a net withdrawal of nearly VND 1,900 billion.

SSI Research estimates that the fund will buy 762 thousand new VIX shares, 162 thousand SSB shares and 103 thousand NAB shares to add to the portfolio. At the same time, some stocks are also "collected" by SSIAM VNFIN Lead ETF such as LPB (631 thousand shares), TCB (462 thousand shares), MBB (152 thousand shares), ...

On the contrary, the fund can sell STB (523 thousand shares), SHB (526 thousand shares), VND (389 thousand shares), VPB (333 thousand shares),...

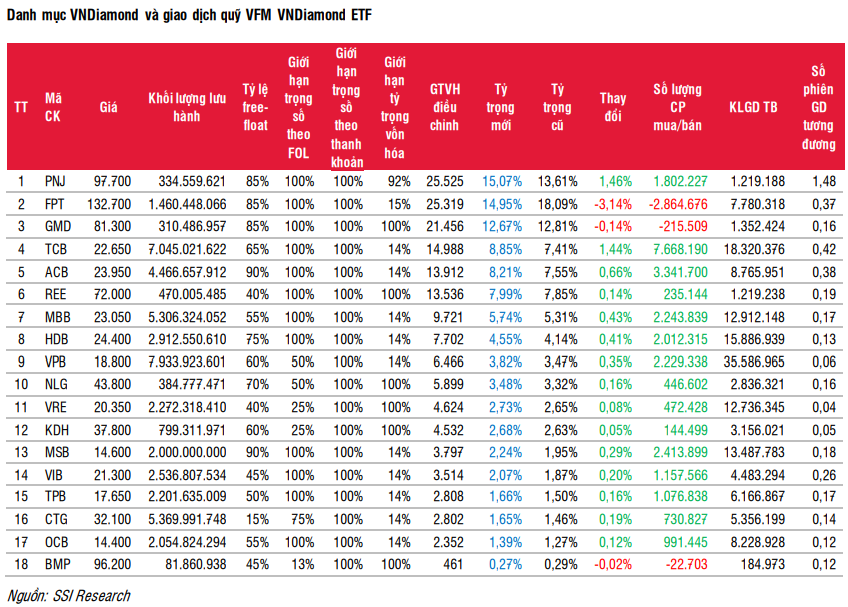

For the VNDiamond index, the portfolio has no changes in composition this period with 18 stocks. Among the ETFs on the market, there are currently 4 ETFs using the VNDiamond index as a reference, including DCVFMVN Diamond, MAFM VNDiamond, BVFVN Diamond and KIM Growth Diamond with a total net asset value of about VND 12,600 billion as of July 15, 2024.

The DCVFMVN Diamond fund alone currently has a total asset value of about VND 12,100 billion, down 30% compared to the beginning of 2024. According to statistics, the fund has been net withdrawn by VND 9,000 billion since the beginning of the year.

SSI estimates that VFM VNDiamond ETF fund can buy strongly nearly 7.7 million TCB shares, 3.3 million ACB shares, 2.2 million MBB shares, 2.2 million VPB shares, 2 million HDB shares, 1.8 million PNJ shares...

On the selling side, the fund can sell 2.9 million FPT shares, more than 215 thousand GMD shares and nearly 23 thousand BMP shares to reduce the proportion of these codes in the portfolio.

Source: CafeF