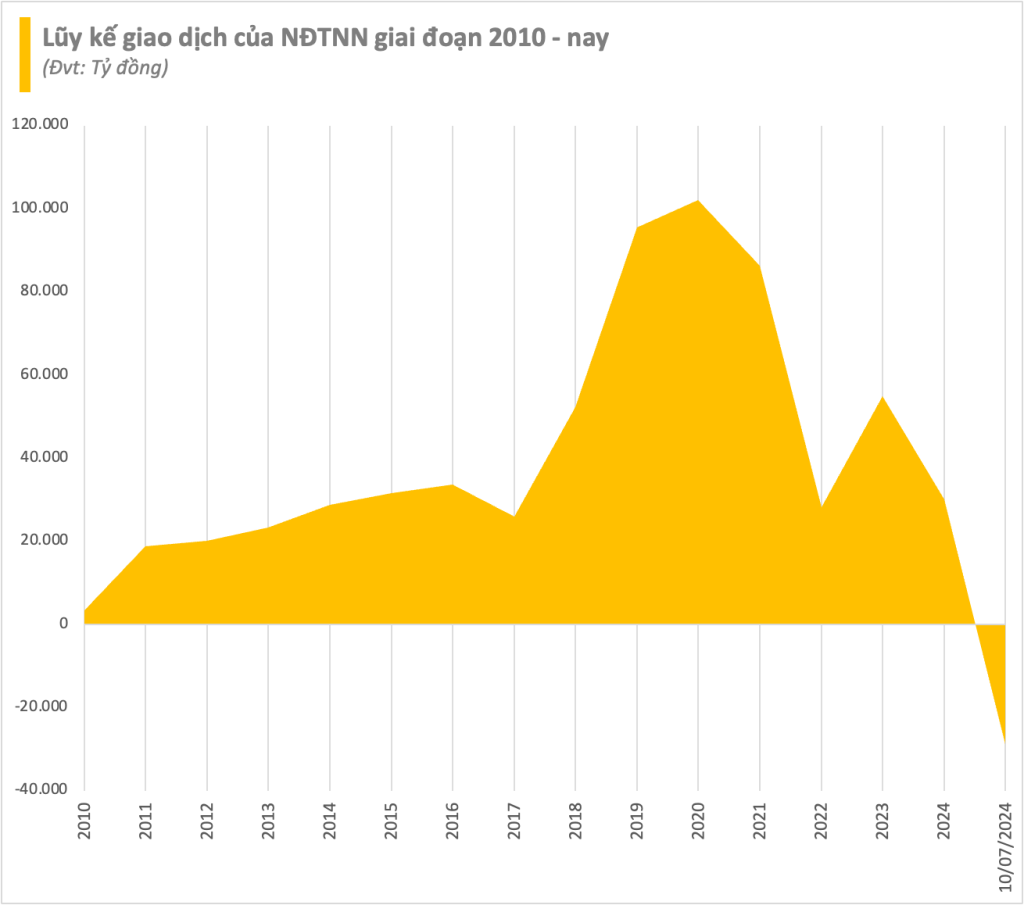

According to cumulative statistics from 2010 to present, foreign capital on the HoSE floor has turned to net selling of nearly 29,000 billion VND.

The Vietnamese stock market is under great pressure from foreign investors as they continue to sell off heavily across the board. The net selling value on HoSE from the beginning of 2024 to the end of the session on July 12 was VND58,882 billion (~USD2.3 billion), breaking the record of net selling of more than VND58,000 billion recorded in 2021.

Thus, just over half way through this year, foreign capital has set a new record. It is not impossible that bigger milestones will be set soon as foreign investors have not shown any signs of stopping dumping, continuously selling thousands of billions of VND each session.

Statistics in the decade from 2010 to the end of 2019, foreign investors mainly net bought Vietnamese stocks, only net sold in 2016 with a not too large value. Especially in 2018, foreign investors disbursed more than 43,000 billion net bought stocks on HoSE,

However, the trend began to reverse in 2020, and the intensity of "dumping" also became overwhelming compared to the previous buying force. After just over 4 years, the net selling momentum of foreign investors has completely eliminated the net buying momentum of the previous 10 years. As a result, the accumulated foreign capital flow from 2010 to present has turned into net selling of nearly 29,000 billion VND.

Many knots can not be untied

In terms of proportion, foreign transactions no longer have as much influence on the market as before, and in some periods they are even somewhat overshadowed by domestic cash flows. However, the continuous net selling of foreign investors will more or less affect the sentiment of domestic investors.

Looking back, the periods of strong net foreign buying were mainly of a temporary nature, taking advantage of the bottom when valuations dropped after deep market falls. This cash flow came in large quantities but also withdrew quickly, causing Vietnamese stocks to lack the motivation for a sustainable “uptrend”.

It should be said that the difference in interest rate environment, monetary policy, high exchange rate... has significantly impacted the actions of foreign investors in recent times. This has caused capital flow restructuring activities globally, weaker growth markets, depreciated currencies or frontier markets will be strongly withdrawn to allocate capital to more efficient markets.

In particular, the net selling trend also shows a certain caution of foreign investors in Vietnamese stocks. The story of upgrading the stock market to attract foreign capital is still just an expectation. In reality, the market has been stuck in the old area for many years, the VN-Index is "rolling" around 1,200 - 1,300 points, and capitalization has not been able to completely break out.

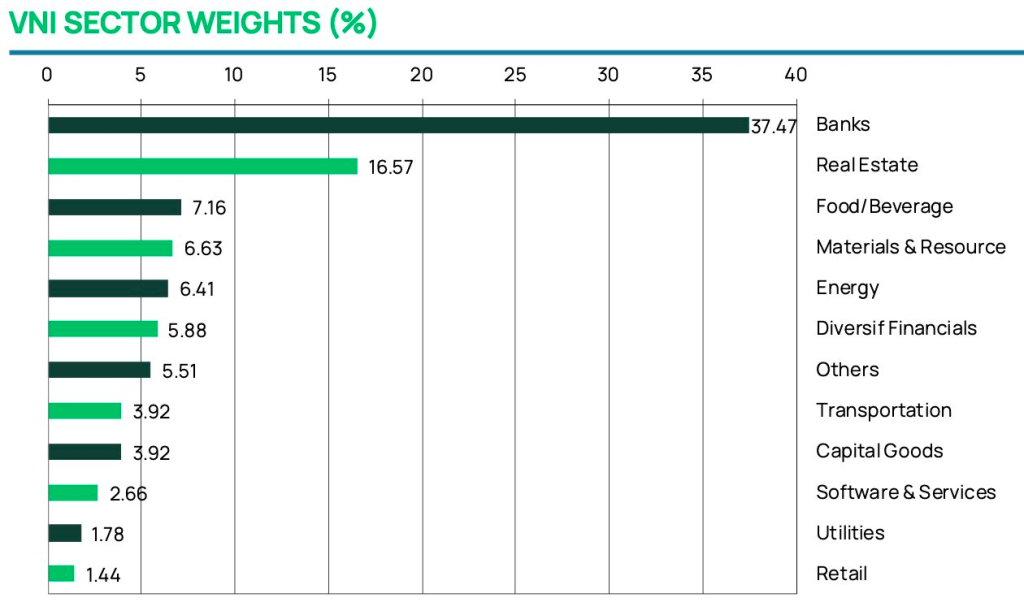

In addition, some specific factors can also have a negative impact on foreign investors, such as the difference in proportion between industry groups on the floor and the lack of "good" stocks. Financial stocks (banking, securities, insurance) and real estate dominate in terms of quantity and capitalization proportion (about 60% of the entire market). These are highly cyclical industry groups and depend heavily on credit growth.

Meanwhile, sectors that are becoming “hot trends” globally such as technology, healthcare, pharmaceuticals, retail, utilities, etc. account for a small proportion with a modest number of stocks. These are the sectors that attract great attention from foreign investors and are often accepted by investors at high valuations. This shortage is one of the barriers that make it difficult for foreign investors to access Vietnamese stocks.

How long will the net selling last?

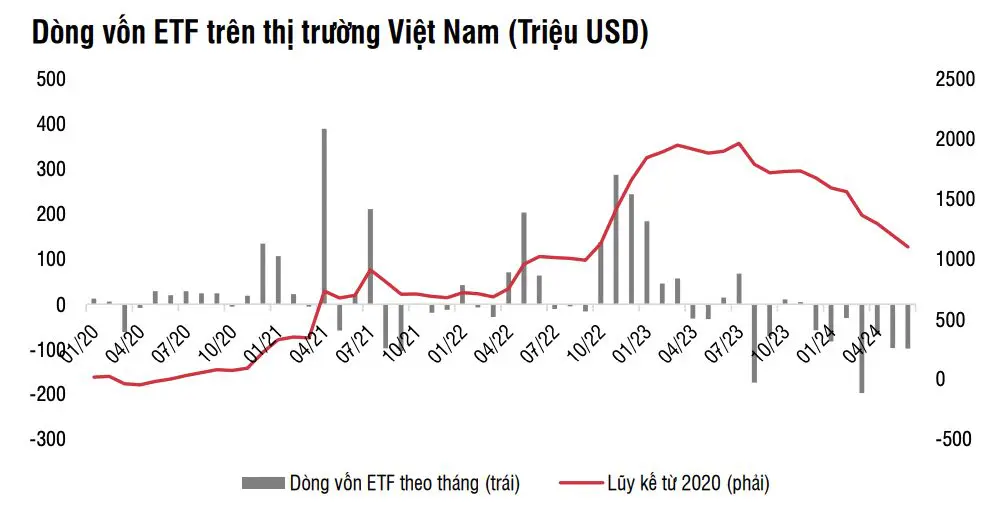

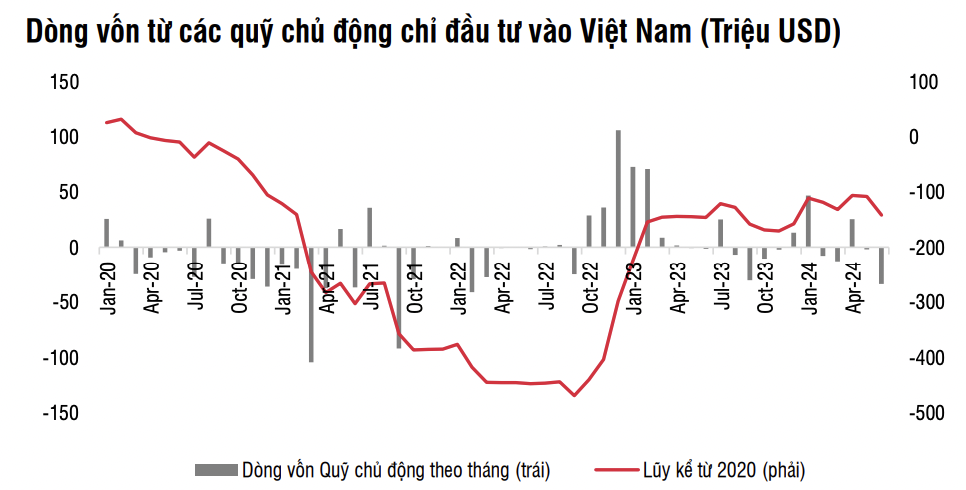

In a recent report, SSI Research assessed that investment cash flow in the Vietnamese stock market recorded a strong net withdrawal. Since the beginning of the year, ETF funds have withdrawn a total of VND 15,700 billion, equivalent to a decrease of about VND 21% in total assets by the end of 2023, bringing the total assets of ETF funds to VND 66,000 billion. At the same time, SSI also observed capital withdrawals from active funds specializing in investing in Vietnam.

According to SSI, with the remaining assets not being too large, the intensity of net withdrawals in the coming time of ETF funds will be much more limited than in the second quarter. Particularly for active funds, with the number of enterprises that can invest quite limited, especially not many options in industries of interest such as technology and risks of interest rates and exchange rates are the factors that have the biggest impact on capital flows into Vietnam at the present stage.

More positively, according to Mr. Bui Van Huy - CEO of Southern Branch of DSC Securities Corporation, foreign investors have net sold more than 50,000 billion VND since the beginning of the year, but the impact on the Vietnamese market is not too great. The proof is that despite foreign investors' net selling, the market still did not fall but remained above the 1,280 point area.

The transaction size of foreign investors only accounts for around 18-20% of the total transaction size of the whole market, much lower than the period before 2020, reaching 30-50% of the total market size.

Source: CafeF