Economic growth data continues to trend positively, creating a basis for expectations that business results of listed enterprises will recover in the second quarter of 2024 and create momentum for growth in the following quarters.

Many investment opportunities in the stock market

Agriseco Research believes that economic growth data continues to trend positively, with each quarter being better than the previous quarter, creating a basis for expecting that the business results of listed companies will recover in the second quarter of 2024 and create momentum for growth in the following quarters, opening up many investment opportunities in the stock market.

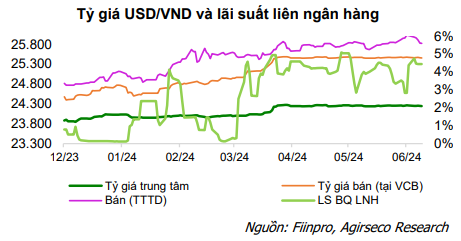

First, the interest rate environment remaining low compared to the 2023 average will help reduce financial costs for businesses.

In addition, credit accelerated at the end of the second quarter and the credit growth target of 15% in 2024 (higher than the 2023 target: 14%) will create conditions to help businesses increase their scale and operating revenue.

At the same time, investment opportunities are opening up as some key industrial products have seen strong production growth in the first 6 months of the year such as steel, rubber, wood, textiles, chemicals, etc., which is expected to help businesses in the industry have high growth in business results in the second half of 2024, especially compared to the low base level in the same period of 2023.

Next, FDI capital invested in Vietnam is growing well in the face of the trend of restructuring the supply chain, which is an important driving force for economic growth in 2024.

Many large technology corporations are promoting investment cooperation in the fields of semiconductors, chips, and renewable energy.

This is expected to help Technology - Telecommunications and Real Estate Industrial Park enterprises benefiti. Simultaneous group Industrial Park also indirectly benefit from ongoing public investment projects related to roads and infrastructure.

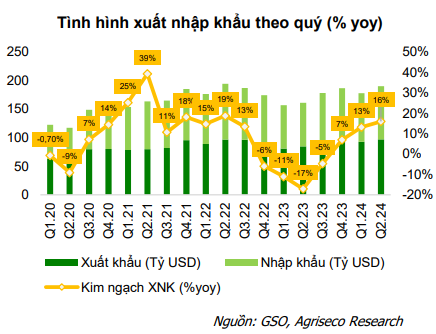

In addition, international trade activities continue to recover strongly with total import-export turnover increasing by 16% compared to the same period in 2023, from which the analysis team expects to help the group of export enterprises record good business results such as chemicals, textiles, seafood, rubber. Besides, related industries such as logistics, seaport also benefit from this trend.

The number of international tourists maintained its highest growth since January 2020 and surpassed the pre-pandemic period thanks to the Government's tourism stimulus solutions, which could create a positive impact on the business results as well as stock price movements of the group of enterprises. aviation, service.

New policies taking effect from the second half of the year are expected to help restore economic demand as well as recovery. real estate market, thereby creating a positive psychological effect on the general market.

The market may continue to face net selling pressure from foreign investors.

At the same time, Agriseco also noted some risks from the complicated international macro situation: the FED maintains high interest rates, fierce strategic competition between major countries, risks to the safety of the commodity supply chain and the less positive growth prospects of major economies.

In addition, exchange rate continues to be a risk to be aware of as it has increased by 4.3% since the beginning of the year due to the large interest rate difference between USD and VND.

The market may continue to face net selling pressure from foreign investors in the coming period after this group has net sold more than 3 billion USD in the past year. These factors will continue to negatively affect the global economy in general and the stock market in particular.

Source: CafeF