Domestic stocks have just experienced a trading week with all 5 sessions increasing, VN-Index surpassing the 1,280 point mark. Many forecasts continue to support the market's recovery trend next week, heading towards the old peak in the context of many expectations about the upcoming Q2 business results.

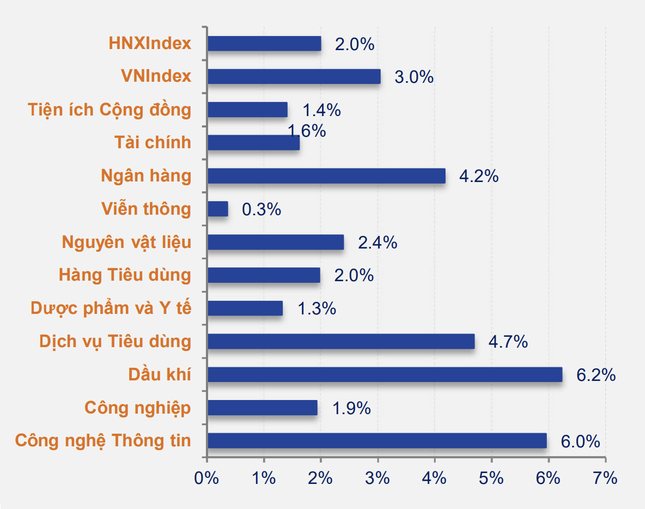

VN-Index ended the week up 37 points (more than 3%) to 1,283 points. However, liquidity on all exchanges decreased compared to last week. The prominent industry group contributing to the market recovery this week was oil and gas with codes PLX (+7,46%), BSR (+5,07%), OIL (+16,53%), PVB (+5,15%)...

Banking pillars returned stronger with BID (+9,36%), VCB (+3,29%), LPB (+14,18%). Retail group traded in green with MWG (+5,13%), DGW (+5,39%), PET (+2,41%)... Chemical stocks also had an impressive week of increase with CSV when there were 3 consecutive sessions of dramatic increase.

Besides, differentiation still occurred in some sectors, such as electricity, POW, adjusted PPC, and especially TV2 decreased by more than 10% with unfavorable information about the Ministry of Industry and Trade terminating the BOT contract of the 3 billion USD super project Song Hau 2 Thermal Power Plant.

The analysis team of Bao Viet Securities (BVSC) commented that the VN-Index had a positive week of increasing points and recovered all the points lost in the previous week. The index's performance was supported by the very positive macro growth results announced at the end of last week, and the exchange rate movements on the black market were somewhat more stable. Next week, the business results of listed enterprises will be the factor that the market is interested in. Cash flow is expected to focus on large-cap stocks and stocks with positive second-quarter business results.

However, the performance of stock groups will be strongly differentiated. Investors should focus on groups with positive second quarter business results such as retail, consumer goods, steel, electricity... or can take advantage of market corrections to accumulate stocks with positive second quarter profit prospects, but prices are in attractive areas such as real estate and exports.

“In addition, next week, the US CPI index for June will also be announced. This information may affect the global stock market as well as the domestic market, because it may change the Fed's interest rate plan in the near future,” experts from BVSC pointed out.

Although the VN-Index had a good week of gains, the analysis team from Saigon - Hanoi Securities (SHS) said that market liquidity is still maintained at a low level, as investors wait for information on businesses' second quarter business results.

“We believe that the market will continue to accumulate positively and if no new negative and uncertain factors appear, the VN-Index is expected to be able to surpass the resistance zone around 1,300 points. Factors such as geopolitical tensions in the world, inflationary pressure, exchange rates, and foreign net selling will cool down,” SHS commented.

Accordingly, short-term investors are advised to maintain a reasonable proportion and continue to monitor market developments at the resistance zone. Medium- and long-term investors should hold their current portfolios, consider increasing new positions, and carefully evaluate based on the second quarter business results and year-end prospects of leading enterprises.

In case the proportion is below average, investors can consider disbursing stocks with good liquidity increase again. The target is leading stocks, forecasted to have good business results in the second quarter, positive prospects at the end of the year.

From the perspective of Ban Viet Securities (VCSC), it is forecasted that next week, VN-Index will continue to maintain its upward momentum, retesting the 1,300-point zone when the selling pressure from the previous week has been almost completely absorbed. The support level in the session is 1,270 points.

Source: CafeF