Although the main index and a series of stocks increased well, market liquidity recorded a drop, in which nearly 10% of transaction value was in one stock.

The market continued to improve in the session of July 4. VN-Index nearly surpassed 1,280 points, but strong selling pressure at this resistance level caused the index to slightly narrow its increase, closing at 1,279.89 points, marking the 4th consecutive increase.

Similarly, HNX also increased slightly by 0.45 points to 241.88 points while UPCoM inched up by 0.36 points to 98.26 points.

Green was recorded on many groups of stocks. The information that the Ministry of Industry and Trade announced the initiation of an investigation to apply anti-dumping tax on galvanized steel products from China and South Korea made steel shareholders happy. Most stocks increased points such as HSG, SMC, TLH, even TVN and TIS hit the ceiling, only HPG reversed the trend and decreased slightly.

The stock group also recorded overwhelming green when VND, HCM, SHS, VDS, BSI, VCI... all increased well. On the contrary, SSI, AGR, VIX, CTS... decreased slightly below 1%.

Banking stocks were mixed as VPB, TPB, LPB, BID, etc. increased in price; however, the “big guys” VCB, CTG or SHB, ACB, MBB adjusted during the day while VN-Index increased well.

Similarly, the real estate business group recorded VHM, KDH, VIC, DPG, GEX… closing in green with increasing points. Meanwhile, strong selling pressure caused KBC, HHV, PDR, NVL, HBC, DXG… to close with decreasing points.

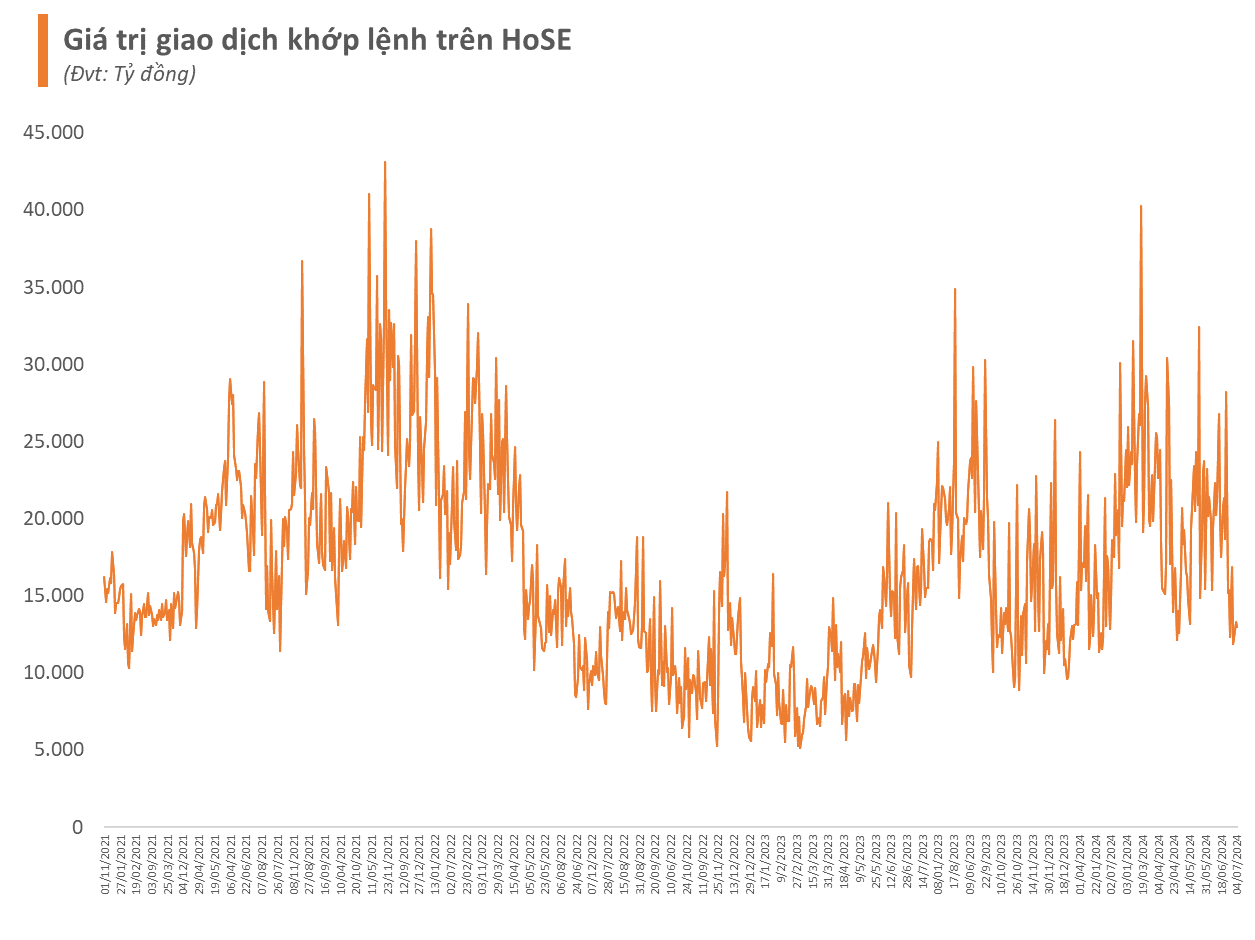

It is worth noting that although the main index and a series of stocks increased well, market liquidity recorded a drop. The transaction value on HOSE was only over 14,000 billion, of which the matched value was less than 13,000 billion VND.

In fact, the decline in liquidity has been happening for about half a month now, in the context that the main index has not really confirmed the trend, which has made investors more hesitant to invest. In addition, objective factors have also had an impact, such as foreign investors selling massively for many months, the net selling value on HoSE in the first half of 2024 has exceeded 53,000 billion VND, aiming to set a record year of net selling of foreign capital in the Vietnamese stock market.

It should be said that the Vietnamese stock market is in an information slump after the AGM season, the Q2 financial report season has not yet taken place. The strong increase in recent times has caused the valuation of many stocks to skyrocket to a high level, no longer so attractive, which has caused liquidity and cash flow to show signs of weakening. Some other reasons may come from the fact that the KRX system has not been able to be implemented, along with the story of upgrading the market still remaining at the expectation, making it difficult for new money to enter.

In the context of general liquidity shortage, cash flow is looking for individual enterprises, typically FPT. Transactions on this stock are still active, even the transaction value in the session on July 4 was approximately VND 1,100 billion - the highest in the market, equivalent to nearly 10% of the total value of the HoSE floor on the same day. The trading volume of more than 8 million shares changed hands - also ranked among the top of the entire floor.

The massive inflow of money has pushed FPT's market price up well, currently standing at 135,800 VND/share, close to the peak of 136,100 VND set at the end of June, up more than 60% since the beginning of the year. FPT's capitalization has thus reached over 198,000 billion VND, ranking 3rd in the list of the largest listed companies in Vietnam, just behind Vietcombank and BIDV.

With the current good liquidity, it is possible that FPT will surpass the peak for the 33rd time since the beginning of 2024. The growth momentum is supported by the sustainable business results of this leading technology group. After the first 5 months of 2024, FPT recorded revenue of VND 23,916 billion and pre-tax profit (PBT) of VND 4,313 billion, respectively up 19.9% and 19.5% over the same period. Profit after tax for parent company shareholders also increased by 21.2% to VND 3,052 billion, corresponding to EPS of VND 2,403/share.

Compared to the revenue plan of VND 61,850 billion (~USD 2.5 billion) and pre-tax profit of VND 10,875 billion, the group has achieved 39% of the revenue plan and 40% of the profit target.

Source: CafeF