On July 15, the HOSE-Index, VNX-Index and investment indices including VNDiamond, VNFin Lead and VNFIN Select will announce their component portfolios for the third quarter of 2024. The relevant ETFs will need to restructure their portfolios by August 2. These indexes will take effect from August 5, 2024.

During this period, the capitalization and industry indices of the HOSE-Index, including the VN30 and VNFIN Lead indices, will change their baskets with changes in composition. Meanwhile, the VNDiamond, VNFIN Select and VNX-Index indices will only update data and recalculate portfolio weights.

SSI Securities has just released a forecast for the index portfolio.

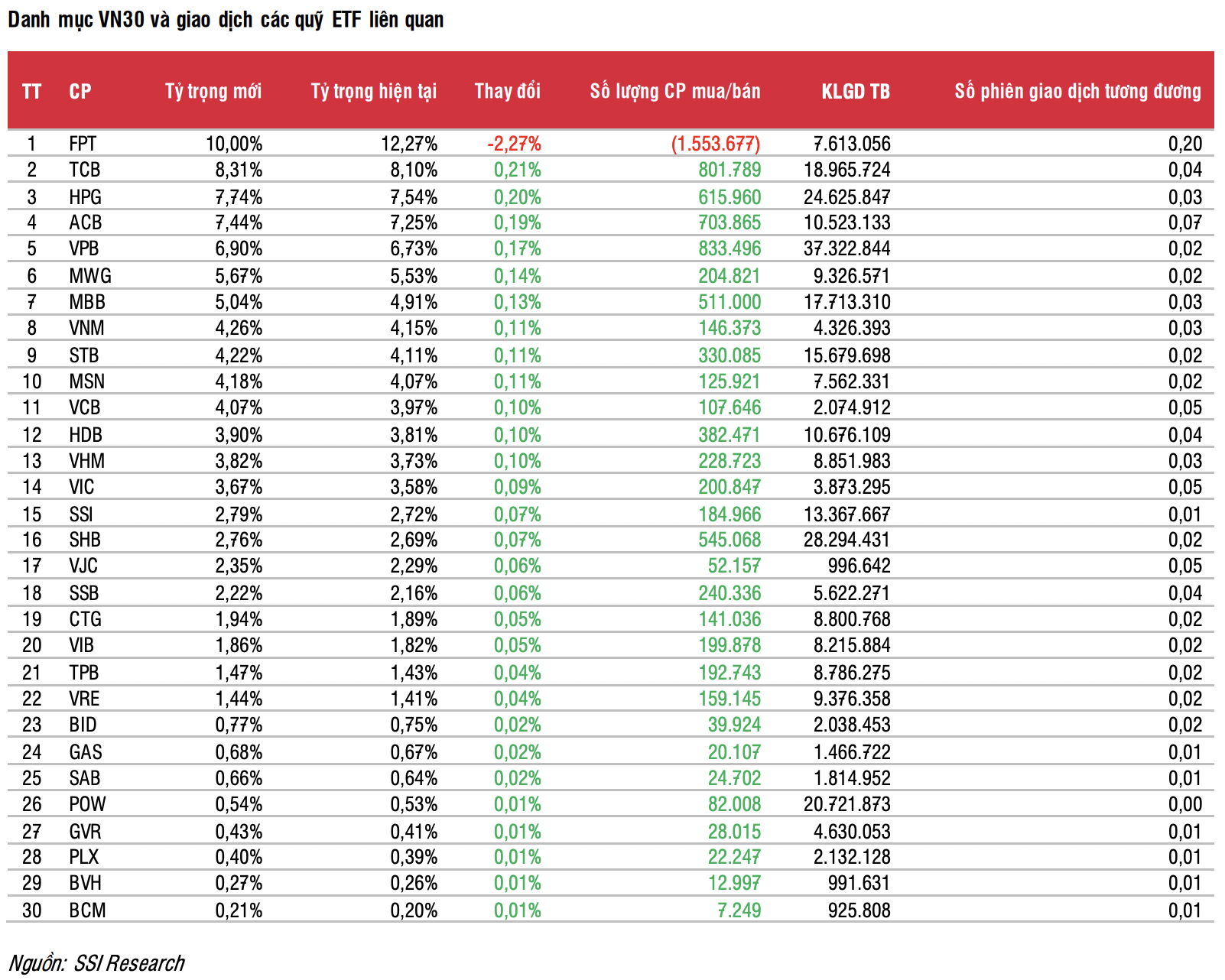

With the VN30 index, SSI Research forecasts that the VN30 index will have no changes in its portfolio. Among the ETFs on the market, there are currently 4 ETFs using the VN30 index as a reference, including DCVFMVN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF and MAFM VN30 ETF with total estimated assets of VND 8,900 billion as of June 28, 2024.

Of which, the DCVFMVN30 fund alone currently has a total asset value of about VND 7,100 billion as of June 28, 2024, down 6% compared to the beginning of 2024, NAV increased 15% compared to the beginning of the year, however, the fund has been net withdrawn by about VND 1,559 billion since the beginning of the year.

Regarding the transactions of ETF funds using the VN30 index as a reference, SSI Securities forecasts that funds may sell nearly 1.6 million FPT shares. On the contrary, funds may buy an additional 833 thousand VPB shares, 802 thousand TCB shares, 703 thousand ACB shares, 616 thousand HPG shares, etc.

For VNFIN Lead index, SSI Research forecasts that 3 stocks VIX, SSB and NAB may be added to the index this period; otherwise, no stocks will be removed.

Assuming the above changes, the index portfolio will include 23 stocks. Currently, the market records that the SSIAM VNFIN Lead ETF fund has a total asset value of about VND 681 billion - a decrease of 70% compared to the beginning of 2024 - referring to the VNFIN Lead index basket. According to statistics, the fund's NAV increased by 11.5% compared to the beginning of the year, the fund was net withdrawn by about VND 1,865 billion after 6 months.

With the above forecast, SSI estimates that the SSIAM VNFinLead ETF will buy about 957 thousand new VIX shares, buy 162 thousand SSB shares, buy 67 thousand NAB shares to add to the portfolio.

Besides, the fund also increased the proportion of some stocks such as TCB (604 thousand shares), MBB (289 thousand shares), ACB (238 thousand shares)...

On the other hand, SHB may be sold by ETF SSIAM VNFinLead about 560 thousand shares due to being removed from the index basket, similarly, the fund also sold EIB (664 thousand shares), VPB (456 thousand shares)….

Source: CafeF