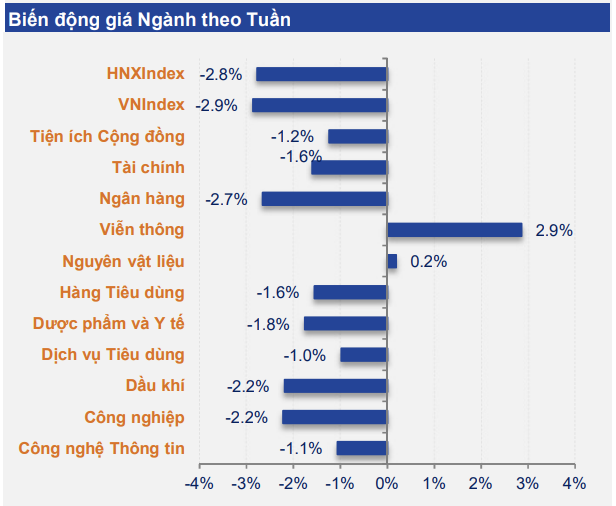

The main index decreased by 2.9% compared to the previous week, down to 1,245 points. Most sectors performed poorly, typically the securities group with speculations appearing among investors related to the KRX system. FTS, BSI, MBS, CTS, AGR… decreased by 9-10% in just 1 week.

Some other industry groups also adjusted strongly, such as steel with NKG (-7,28%), HSG (-5,16%), TLH (-10,26%), VGS (-8,51%)... Banking stocks were flooded with red with TCB, VPB, STB, MBB down 4 - 6%..

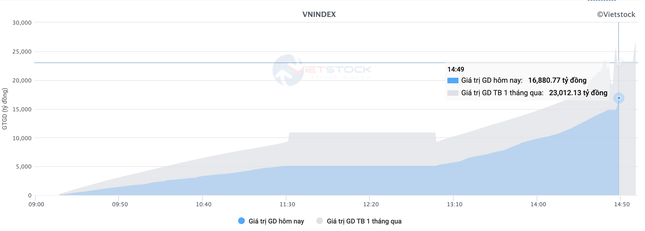

Foreign investors continued to net sell all 5 sessions of the week with a total selling value of up to 4,539 billion VND, focusing on FUEVFVND and FPT fund certificates.

Mr. Dinh Quang Hinh - an expert from VNDirect Securities - commented that after a week of adjustment and the VN-Index losing the psychological mark of 1,250 points, the market received some supportive information at the end of the week. The newly announced supportive information could be a "spiritual medicine" for investors after the recent strong adjustment.

On the evening of June 28 (Vietnam time), the US released the latest data on personal consumption expenditure (PCE) which was flat in May and increased by 2.6% compared to the same period last year, close to the market forecast. The newly released US inflation data is the expected information for the market, reinforcing the expectation that the US Federal Reserve (Fed) may cut the operating interest rate in the second half of the year.

Domestically, the General Statistics Office has announced positive macroeconomic data for the second quarter. Gross domestic product (GDP) in the second quarter increased by 6.931% year-on-year, exceeding market forecasts. With this result, according to Mr. Hinh, Vietnam can completely achieve this year's growth target of 6.51% year-on-year. However, certain inflationary pressures remain, as the consumer price index (CPI) in June increased by 0.171% year-on-year and by 4.341% year-on-year.

Mr. Hinh commented that next Monday will be a very important session for VN-Index to confirm the psychological level of 1,250 points. At the same time, the market will enter the season of announcing second quarter business results, with many forecasts showing continued profit growth.

“Investors should stop selling off in this area, holding stocks now will bring quite positive profits in the next 3 months. Investors need to be ready to disburse if the VN-Index adjusts to the strong support zone of 1,200 - 1,220 points, prioritizing industries that have not increased strongly in the past such as banking, real estate, securities, electricity and exports,” Mr. Hinh recommended.

The analysis team of Nhat Viet Securities (VFS) commented that the continued escalation of exchange rates affected investor sentiment and cautious cash flow. Liquidity focused on sessions of sharp decline, while recovery sessions occurred with low liquidity. The absence of demand to support prices showed investors' hesitation and reserve, as the market continuously lost nearby support zones.

VFS believes that investors should keep the stock ratio low, from 30-50%, and continue to monitor price movements in the 1,200 - 1,230 point range to assess the possibility of a bottom.

Entering July, VFS forecasts 2 scenarios for the market:

Scenario 1, with selling pressure somewhat weakened, VN-Index may form a fluctuation zone of 1,230 - 1,250 points.

Scenario 2, VN-Index immediately recovers. This could be a signal that the correction pressure will soon end, VN-Index is aiming to retest the 1,280 point area. At that time, investors can increase the proportion of stocks again, focusing on the group of stocks that are stronger than the market.

Source: CafeF