At the end of today’s trading session (June 28), strong selling pressure suddenly increased, pushing the VN-Index to close down nearly 14 points. The “NAV closing effect” was not very smooth.

VN-Index could not maintain the 1,250-point mark in the last trading session of the week. In just the last hour of the trading session, strong selling pressure continuously poured into the market. More than 6,000 billion VND poured into the market at that time, even higher than the liquidity of the entire morning session. VN-Index at one point dropped by 19 points, narrowing the decline towards the end of the session thanks to the emergence of bottom-fishing demand.

Today is the last session of June, which is also the closing time for NAV (net asset value) of securities investment funds. Many investors expect that the prices of many stocks will be pulled up so that the funds can close NAV to increase their operating efficiency. However, the general market moves in the opposite direction of expectations with red dominating.

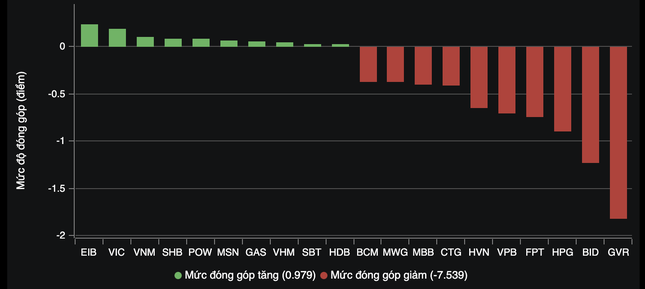

VN30 basket adjusted simultaneously, GVR, BID, HPG, FPT, VPB... were the most negatively traded codes. 18/30 stocks were in red. On the contrary, only 9 stocks increased in price. HoSE also recorded 355 stocks decreasing in price. Influential industry groups such as banking, real estate, technology, retail, chemicals... adjusted simultaneously.

Domestic technology stocks are not very positive, similar to the developments of the world's technology giants. After Nvidia's decline, domestic technology stocks also adjusted. FPT was net sold by foreign investors for nearly 4,700 billion VND in June alone. Today, FPT is also one of the focus of foreign capital net selling, nearly 255 billion VND, the second highest on the whole market. FPT, CMG, ELG, and Viettel group all adjusted.

The rare industry group that went against the market trend continued to be maritime transport. Despite strong selling pressure at the end of the session, HAH, VSC, TCL, VOS… still increased in price. The petroleum group had POW, GAS increase in price. Construction stocks recorded good increases in FCN, HBC, FCN increased by 5.6%. These few stocks did not have a large impact on the general market, due to their small capitalization and liquidity.

At the end of the trading session, VN-Index decreased by 13.77 points (1,09%) to 1,245.32 points. HNX-Index decreased by 2.48 points (1,03%) to 237.59 points. UPCoM-Index decreased by 0.99 points (1%) to 97.54 points.

Liquidity increased sharply at the end of the session due to strong selling pressure, HoSE matched value reached nearly 16,900 billion VND. Foreign investors continued to net sell thousands of billions, with a value of up to 1,137 billion VND.

Source: CafeF