In its newly released strategic report, Tien Phong Securities (TPS) assessed that the favorable macro environment is creating favorable conditions for the stock market in the second half of 2024. Global inflation and commodity prices have cooled down, global trade is positive, and many central banks (including the Fed) are moving towards monetary easing. Vietnam's GDP growth is higher than last year, exports have recovered, and the consumption and manufacturing sectors continue to maintain growth momentum. At the same time, the State Bank of Vietnam expects to continue to maintain the current loose monetary policy.

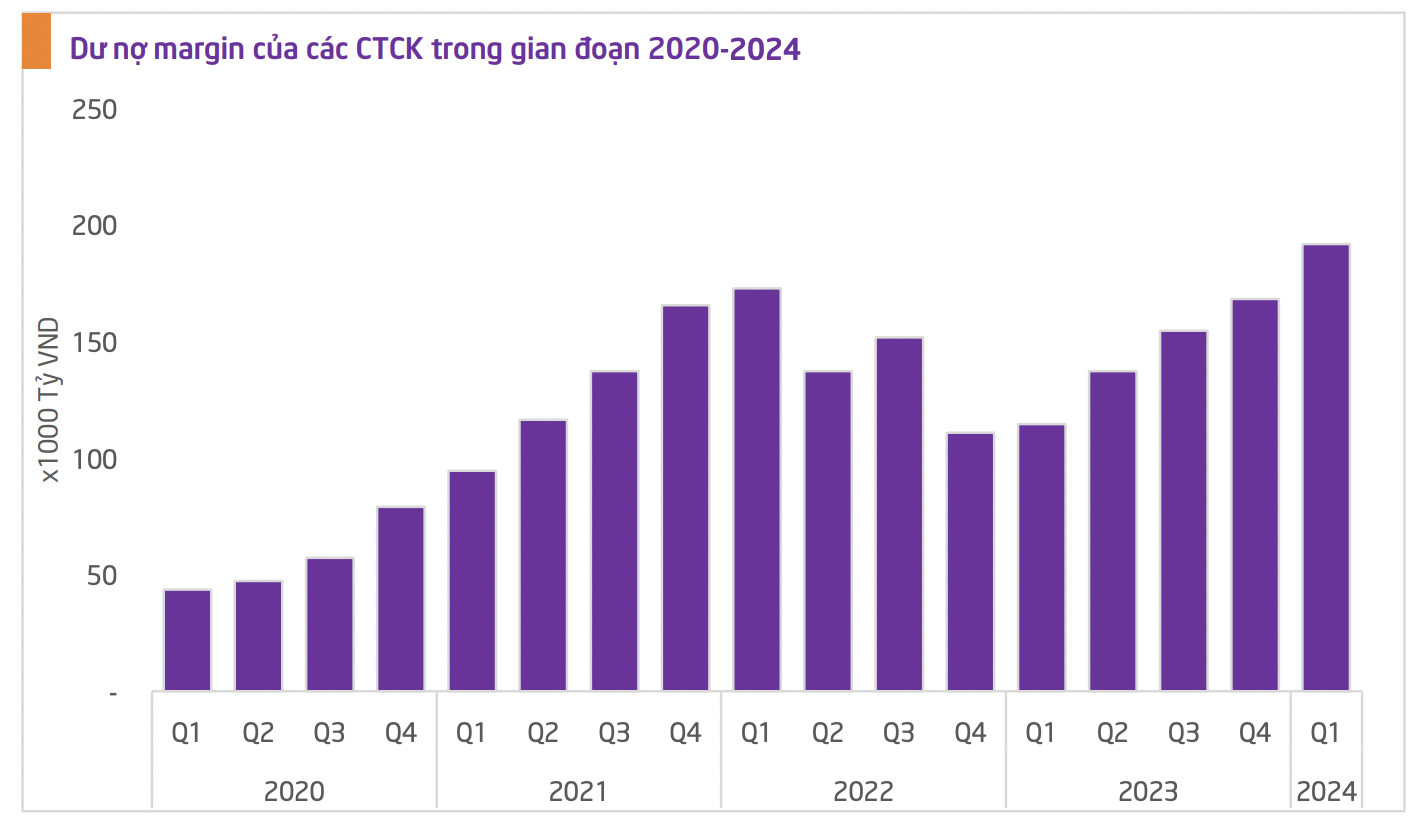

According to TPS, many factors will support cash flow in the stock market in the second half of this year, especially the margin purse from securities companies being expanded thanks to the "game" of increasing capital in the period from the end of 2023 to the first half of 2024. As of the end of the first quarter of 2024, the ratio of outstanding margin loans/equity is relatively low, reaching 54.5%, lower than the peak in early 2022 of 120% and lower than the prescribed safety level (2 times). The amount of margin loans in the second half of the year is expected to increase significantly, the margin lending space is still very large and will support the stock market's growth momentum.

TPS's analysis team assessed that the second half of this year will be the premise for the market's Uptrend from the story of the market upgrading, which is brighter when the MSCI assessment report in June 2024 showed that Vietnam has improved the transferability criteria. At the same time, the KRX system is being urgently completed, expected to be deployed from September, which will further strengthen the market's ability to upgrade. In addition, important laws such as the Land Law, Real Estate Business, etc., which will take effect from the third quarter of this year, will also create momentum for the market to increase points.

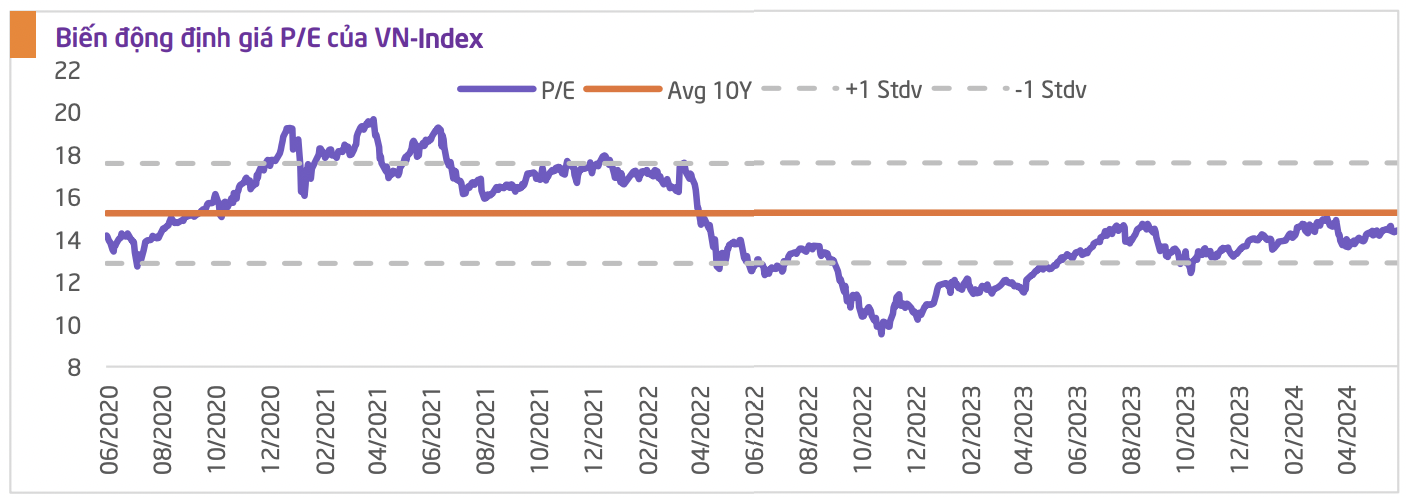

Along with that, the April adjustment has pulled the market's P/E valuation to the lowest level of 13.7x times. After the recovery, the VN-Index is currently trading at a P/E of 14.4x times. Accordingly, the current valuation of the market is still attractive compared to the profit recovery prospects of businesses this year and compared to the 10-year average of 15.2x times.

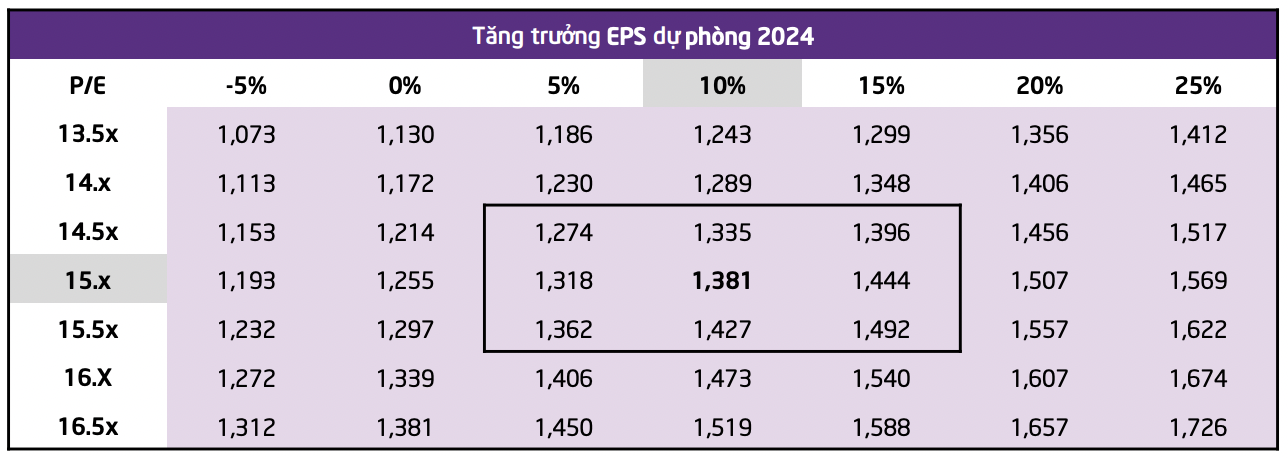

For the 2024 outlook, TPS's base case forecasts the VN-Index to fluctuate around the target of 1,381 points, corresponding to a cautious growth of 10% for the whole year and a target P/E of 15.x times (equivalent to the average P/E of the last 10 years).

From a more optimistic perspective, VN-Index could reach 1,444 points with a profit growth scenario of 15% when macro difficulties will ease, and world central banks will loosen monetary policies. Thereby stimulating consumption growth again, creating a premise for Vietnam's export activities.

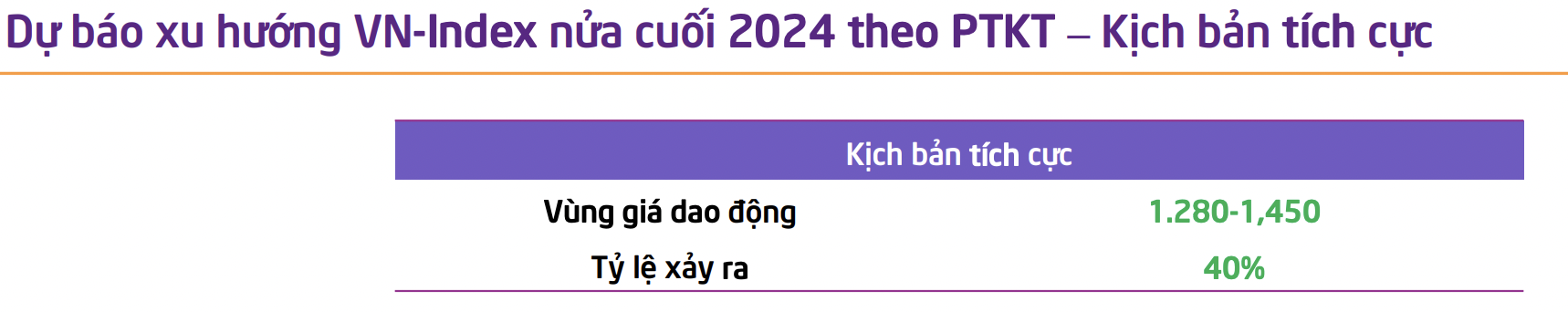

However, if looking at the short term in June or July, TPS forecasts that the main index is likely to have another correction because the reaction to the 1,300 point price zone is still quite cautious. However, in the medium term, the index is still supporting the formation of an uptrend, so the short-term correction is only to gain momentum and create a strong uptrend and also open up an attractive buying zone for value investors who want to hold for the medium and long term.

Source: CafeF