With the recovery of the macro economy, it is forecasted that the demand for borrowing and issuance of corporate bonds will accelerate in the second half of 2024, helping credit growth to achieve the target of 14-15% for the whole year.

According to the latest forecast of VIS Rating, in the next 1-3 years, banks are expected to need VND283 trillion in Tier 2 capital bonds to support internal capital sources and maintain capital adequacy ratios.

About 55% of new Tier 2 capital raising bonds will be issued by state-owned banks as their Tier 2 capital will be significantly reduced. According to the regulations, outstanding Tier 2 capital raising bonds included in equity will be reduced by about 20% per year in the last 5 years of the bond term.

Banks will need to issue new Tier 2 capital bonds to replace the depreciated bonds and increase their capital adequacy. Some small private banks with weak profitability will issue Tier 2 capital bonds to support their capital adequacy ratio. In addition, some medium and large private banks will use Tier 2 capital bonds to support their high credit growth targets.

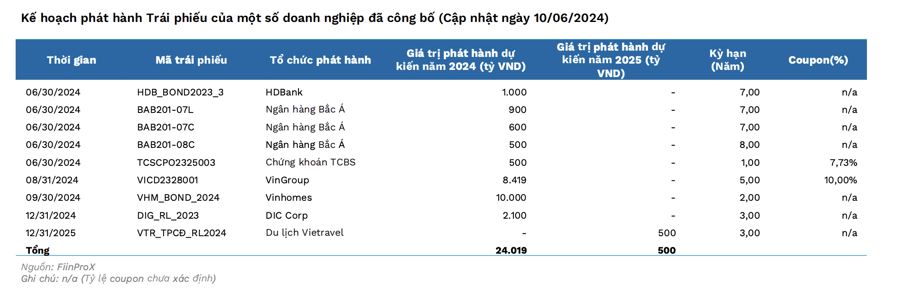

According to another record of FiinRatings, as of June 10, 2024, only a few banks have announced plans with specific issuance dates with a total value of about VND 3,000 billion. For non-banking enterprises, the issuance plan will depend on the macro situation as well as the interest rate environment.

However, according to FiinRatings, corporate bond issuance activities of credit institutions will be busier in the coming time.

Lending interest rates have fallen to very low levels and banking sector liquidity is abundant, credit has continued to increase slowly since 2023. This reflects the weak capital absorption capacity of the economy, leading to low output from credit institutions, including customer loans and corporate bond investments.

With the recovery of the macro economy, FiinRatings forecasts that the demand for borrowing and issuance of corporate bonds will accelerate in the second half of 2024, helping credit growth to meet the State Bank's annual target of 14-15%.

Vietnam’s exports have grown again thanks to the economic recovery in major markets, leading to improved capital demand from manufacturing enterprises. Credit growth for the real estate business sector, including corporate bond investment by commercial banks, has recovered as legal problems have gradually been resolved. In addition, newly passed Laws are expected to facilitate the recovery of the real estate market.

To meet the increased credit demand in the second half of the year, credit institutions will need to consolidate medium- and long-term capital sources, including issuing bonds to increase Tier 2 capital. Therefore, corporate bond issuance activities of credit institutions will be busier in the coming time.

In addition, as banks remain the main investors in corporate bonds in the current legal and policy context, diversifying the form of financing for businesses by banks will also pave the way for continued bond recovery.

“As the largest group of corporate bond investors, the fact that credit institutions are boosting output through corporate bond investment channels is an important factor helping the corporate bond market become more vibrant in the second half of this year,” FiinRatings expects.

The primary market in May 2024 witnessed strong growth with a total issuance value of VND 23.2 trillion, mainly from credit institutions, while the real estate group decreased by VND 30.31 trillion compared to the previous month. Taking advantage of low interest rates, credit institutions increased the issuance of medium and long-term bonds to ensure the safety ratios of the State Bank as well as to prepare capital sources when credit growth is likely to recover in the second half of the year.

BIDV and TCB have the largest issuance volume of VND5.3 trillion and VND3 trillion. Newly issued bonds are mainly concentrated in terms of 2-3 years and 7-8 years. Bonds of credit institutions have an average term of 5 years and an average interest rate of 5.4%, specifically, state-owned bank BIDV issues long-term bonds, while private credit institutions mainly issue 3-year bonds. The real estate group mainly records a series of bonds belonging to Vingroup with an average term of 2 years and an issuance interest rate of 12-12.5%, the purpose of debt restructuring.

Bond maturity pressure continues to be high in Q3 and Q4/2024 with the Real Estate sector accounting for 64% of total maturing corporate bonds, in the context that many businesses have to request debt payment deferral and adjust buyback plans.

Source: CafeF