After only about 2 weeks, this stock has increased by 72% to 35,500 VND/share, the highest in more than 5 years, since November 2018. If calculated from the beginning of 2024 until now, the market price has doubled.

Along with broadband telecommunications infrastructure, Internet of Things (IoT), Cloud computing and Data Centers play a very important role in shaping digital infrastructure. Vietnam is considered one of the fastest growing Data Center markets in ASEAN.

This trend opens up opportunities for many businesses in the field of Data Center infrastructure solutions, including Global Electrical Engineering Corporation (code GLT). This business has more than 10 years of experience and has participated in building and supplying equipment for dozens of Data Center projects both domestically and internationally.

Most recently, at the end of May, the consortium of GLT and Tan Tien Automation Technology JSC won a bid with a value of VND277 billion and an expected implementation time of 470 days, with the Military Industry - Telecommunications Group (Viettel) as the investor.

The scope of work is to supply materials, equipment and implement construction and installation of chiller (cooling) system and raised floor for machine room of the project to invest in building infrastructure for the main station machine room at Viettel Hoa Lac Technical Center in 2022. Viettel Hoa Lac is currently the largest data center in Vietnam in terms of total investment scale with a total floor area of 21,000 m2 and a total power capacity of 20 MW.

After the news of winning the big bid, GLT shares started to make waves and started to break out from mid-June with many sessions of ceiling price increase. After only about 2 weeks, this stock increased by 72% to 35,500 VND/share, the highest in more than 5 years, since November 2018. If calculated from the beginning of 2024 until now, GLT's market price has doubled.

GLT was established in October 1996 and officially became a Joint Stock Company on December 28, 2005. In addition to the field of Data Center infrastructure construction, GLT is also known as a leading unit in consulting, designing, providing equipment and advanced solutions in the fields of lightning protection, green energy, telecommunications infrastructure investment as well as providing high-quality maintenance services.

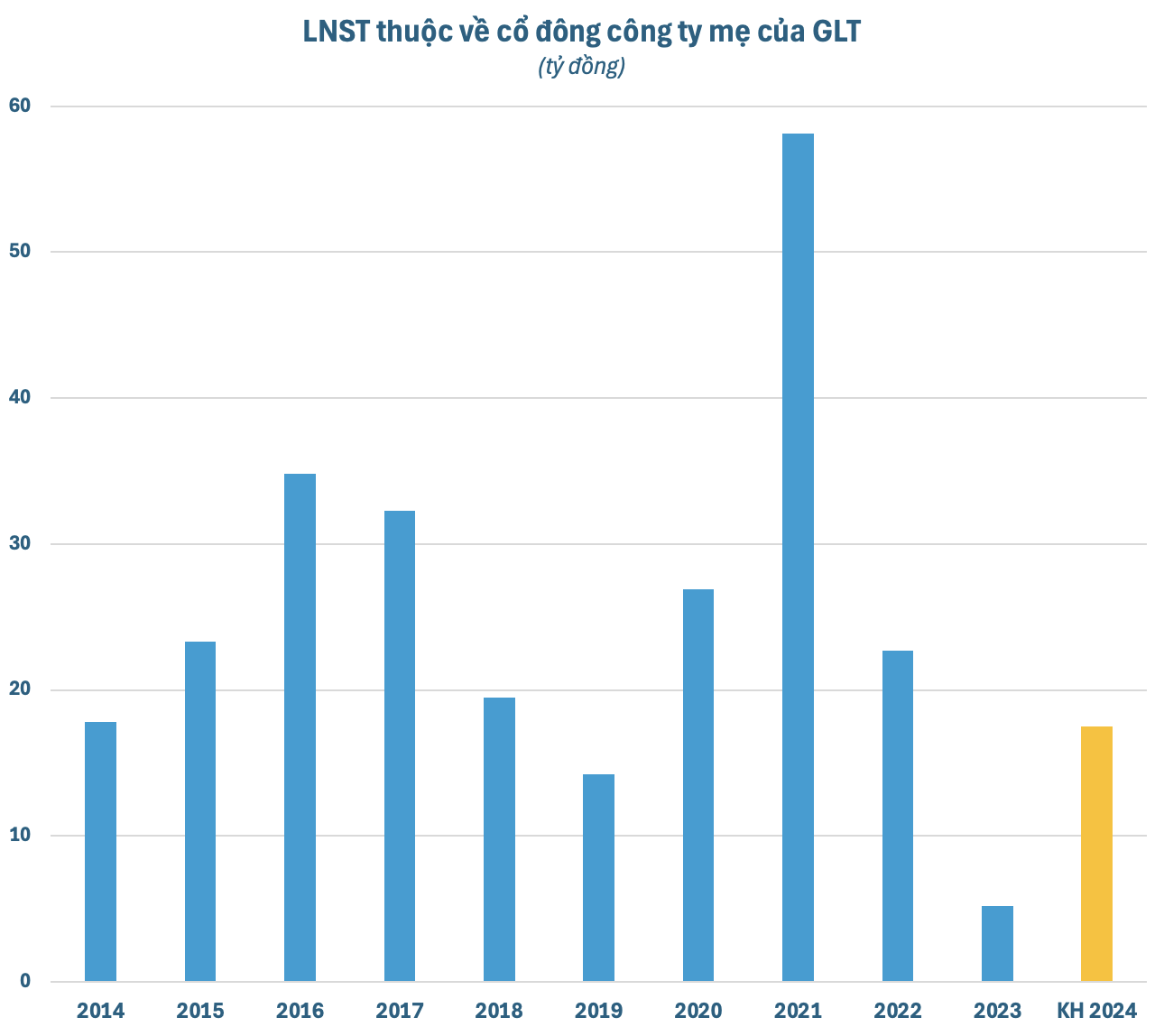

However, GLT's business results in recent years have not been very bright. The 2021 fiscal year recorded record profits, mainly due to unusual activities when GLT transferred 100% of capital contribution at GTI (the unit owning 238 BTS stations), earning an extraordinary profit of more than 50 billion. In the following 2 consecutive years, GLT's profits decreased sharply.

In the 2023 fiscal year (April 1, 2023 - March 31, 2024), GLT recorded net revenue of VND 83 billion, down VND 871 billion compared to the previous fiscal year. Profit after tax attributable to the parent company's shareholders was only VND 5.2 billion, down VND 771 billion compared to the previous fiscal year and the lowest level ever. With the results achieved, the enterprise did not complete the set plan.

Business results are not as expected. However, according to the documents of the 2024 Annual General Meeting of Shareholders scheduled to take place on July 2, GLT's Board of Directors will still submit to shareholders a dividend plan for 2023 at a rate of 25% in cash, equivalent to the previous year 2022. The dividend plan for 2024 is expected to be 15%.

Assessing the economic landscape in 2024, GLT's board of directors believes that there are still many challenges. Therefore, the company plans to continue to focus on developing and consolidating core business activities to bring optimal efficiency such as precision air conditioning and data center infrastructure; implementing solar project investment; lightning protection equipment.

Notably, GLT's business plan for fiscal year 2024 (April 1, 2024 - March 31, 2025) is ambitious with a consolidated net revenue target of VND300 billion and a profit after tax attributable to parent company shareholders of VND17.5 billion, respectively 3.6 and 3.3 times higher than the previous fiscal year. However, this profit level is still lower than the previous period of 2020-2022.

Source: CafeF