If upgraded by MSCI, the capitalization of Vietnamese stocks will account for 0.44% in the MSCI Emerging Market Index basket. This implies that there will be a capital flow of about 4 billion USD from foreign investment funds referencing this index pouring into the Vietnamese stock market.

Dragon Capital Securities Company (VDSC) has just published an analysis report on the prospects for upgrading the market according to MSCI's assessment, stating that the process of upgrading the Vietnamese stock market from frontier to emerging is still facing some "bottlenecks".

Not long ago, in the newly published global market access report, the market rating organization MSCI assessed that Vietnam's "transferability" criterion had been changed from needing improvement "-" to no major problem "+" thanks to the increase in off-exchange transactions and physical transfers that can be made without prior approval from the management agency.

However, Vietnam still has 8 criteria that need to be improved to complete the set of 18 criteria of MSCI, including: Foreign ownership limit; Foreign room; Equal rights for foreign investors; Degree of freedom in the foreign exchange market; Investment registration and account establishment; Market regulations; Information flow and Clearing.

EXPECTATION OF 4 BILLION USD OF FOREIGN CAPITAL WILL FLOW INTO VIETNAMESE SECURITIES WHEN UPGRADING IS SUCCESSFUL

According to VDSC, with leading market share and reputation built over more than 50 years in the global investment community, markets classified by MSCI will benefit greatly in attracting investment as more and more active investment funds/fixed investment funds choose MSCI as a reference index.

Currently, the Vietnamese stock market is classified by MSCI as a "Frontier Market" market and is subject to consideration for upgrading to an "Emerging Market" market.

If the upgrade process is successful, the VDSC analysis team believes that the Vietnamese market will have the opportunity to welcome a huge capital flow from investment funds using the MSCI Emerging Market Index as a reference, and at the same time re-evaluate the market with a higher multiple.

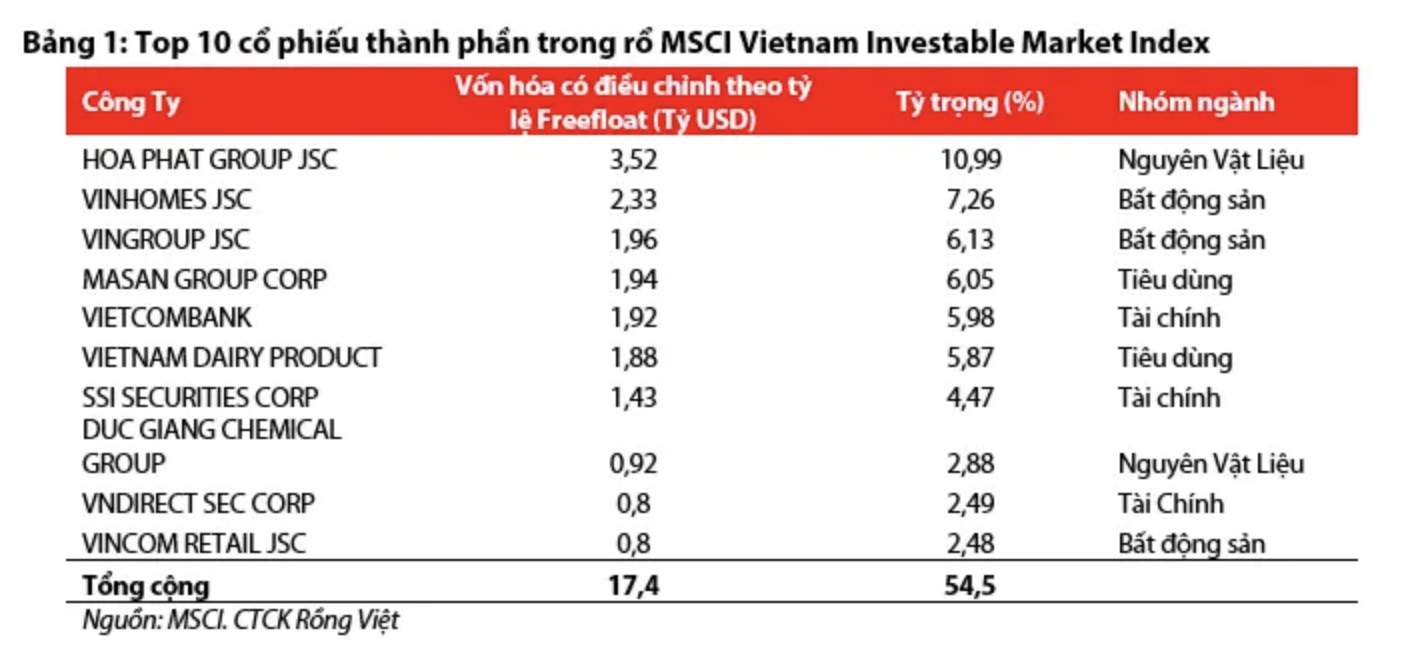

According to VDSC's recent estimate, the capitalization of MSCI Vietnam Investable Market Index (IMI) reached 32 billion USD as of May 31, 2024. Meanwhile, the capitalization of MSCI Emerging IMI is worth 7,239 billion USD.

If upgraded by MSCI, the capitalization of Vietnamese stocks will account for 0.44% in the MSCI Emerging Market Index basket. This implies that there will be a capital flow of about 4 billion USD from foreign investment funds referencing this index pouring into the Vietnamese stock market. Accordingly, the added stocks are all under MSCI Vietnam IMI.

Specifically, MSCI classifies markets according to the following three criteria: Economic development; market size and liquidity, and especially market access to global capital flows, thereby reflecting the development of financial markets and domestic economies.

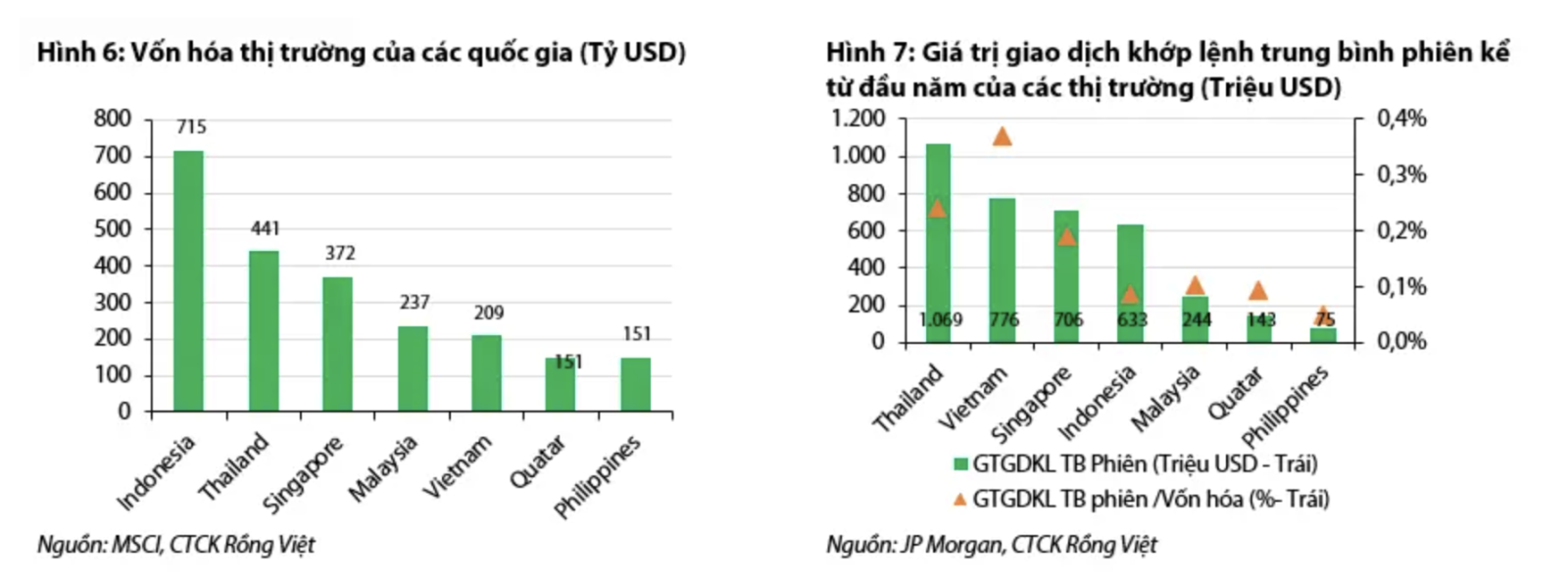

While the economic development factor does not need to be considered, Vietnam has met all the factors of scale and liquidity, and this criterion of Vietnam has even surpassed many markets in the emerging market classification in the region.

Accordingly, the total capitalization of the Vietnamese stock market reached more than 200 billion USD, larger than the scale of markets in Qatar and the Philippines. The liquidity of the Vietnamese market is at a high level of 776 million USD/day, equivalent to markets in the region such as Indonesia, Malaysia and Singapore.

However, VDSC believes that “market accessibility” for global investors is still a major bottleneck of the Vietnamese stock market. Therefore, according to MSCI’s “Global Market Accessibility Assessment” report in its latest annual review, Vietnam continues to be classified as a Frontier Market. Despite improvements in the “transferability” criterion, there are still 8 key criteria that need to be improved to meet the requirements for market upgrade.

TWO BOTTOM LINES TO BE REMOVED SOON?

After studying the MSCI assessment report in June 2024, VDSC has summarized the main "bottlenecks" in the upgrading process of the Vietnamese market, including: The level of openness in foreign ownership, the ease of international capital inflow/outflow, and finally the efficiency of the market's operating mechanism are the points that need to be improved.

However, according to VDSC, to be upgraded, it is only necessary to improve the criteria of openness in foreign ownership and the efficiency of the market's operating mechanism, because the criteria of capital flow restrictions are more important than the need to have a foreign exchange market for domestic currency both domestically and internationally.

In terms of openness to foreign ownership, Vietnam’s quantitative factors are similar to Thailand’s. However, in terms of qualitative factors, according to the investor community’s assessment, Thailand’s adoption of the “non-voting common stock – NVDR” policy has helped the country significantly improve its “market access” criteria and be upgraded to emerging market status.

Considering the criteria for the effectiveness of the market operation mechanism for foreign investors, the lack of a binding mechanism for information disclosure and updating of legal regulations in English as well as the lack of widespread application of international financial reporting standards (IFRS) make the market organization not up to standard in the eyes of foreign investors.

In addition, the current regulation requires that there must be enough 100% of money before placing a purchase order (pre-funding mechanism) to limit the risk of default before the goods (securities) are transferred to the investor's account, also creating additional barriers to transactions for foreign investors. "This is not consistent with international standards on the DvP (Delivery versus Payment) mechanism, where money and goods transactions must take place simultaneously," VDSC stated in the report.

In short, to be considered for upgrading according to MSCI criteria, the Vietnamese stock market needs to resolve bottlenecks regarding foreign investor ownership limits, public company information disclosure standards, and trading operations mechanisms to improve “market accessibility” in the eyes of international investment organizations and indirectly increase the opportunity for market upgrading by MSCI.

VDSC believes that in the short term, bottlenecks in information disclosure standards and transaction operation mechanisms can be resolved soon and feasibly. Specifically, the mandatory application of IFRS from 2025 will help improve the “information flow” criterion to investors in the near future.

In addition, the "pre-funding" bottleneck is expected to be resolved when the process of collecting opinions and completing the Draft Circular amending and supplementing a number of articles of the circulars regulating securities transactions on the securities trading system is making positive progress.

“Meanwhile, the bottleneck related to foreign investor ownership limits will require more time, from the efforts of managers and listed organizations,” VDSC commented.

Source: Stockbiz