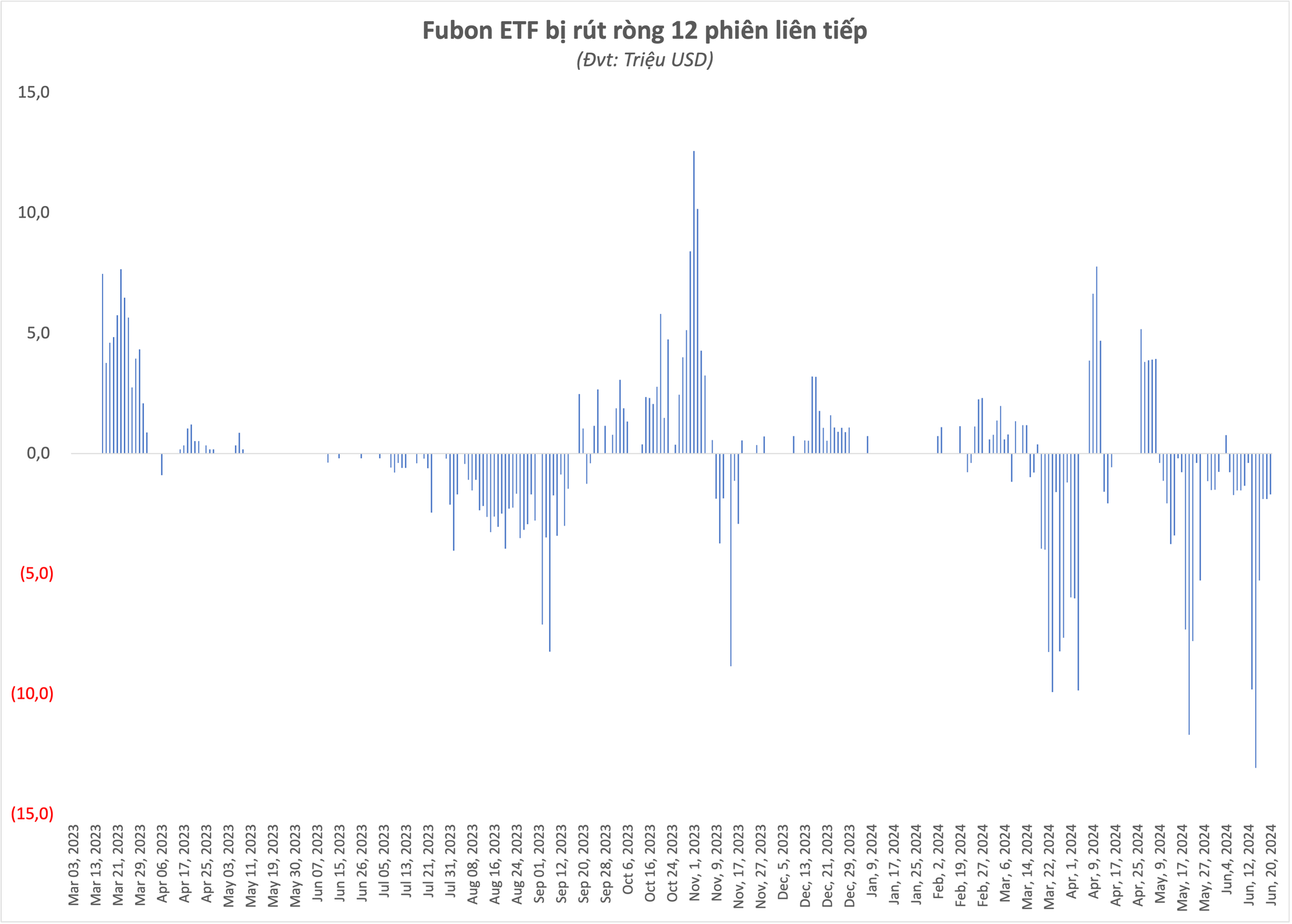

Foreign funds have just sold out and removed a stock from their portfolio. According to statistics, the Fubon FTSE Vietnam ETF foreign fund has withdrawn net for 12 consecutive sessions, with a total net withdrawal of 41 million USD, equivalent to 1,034 billion VND of Vietnamese stocks being net sold.

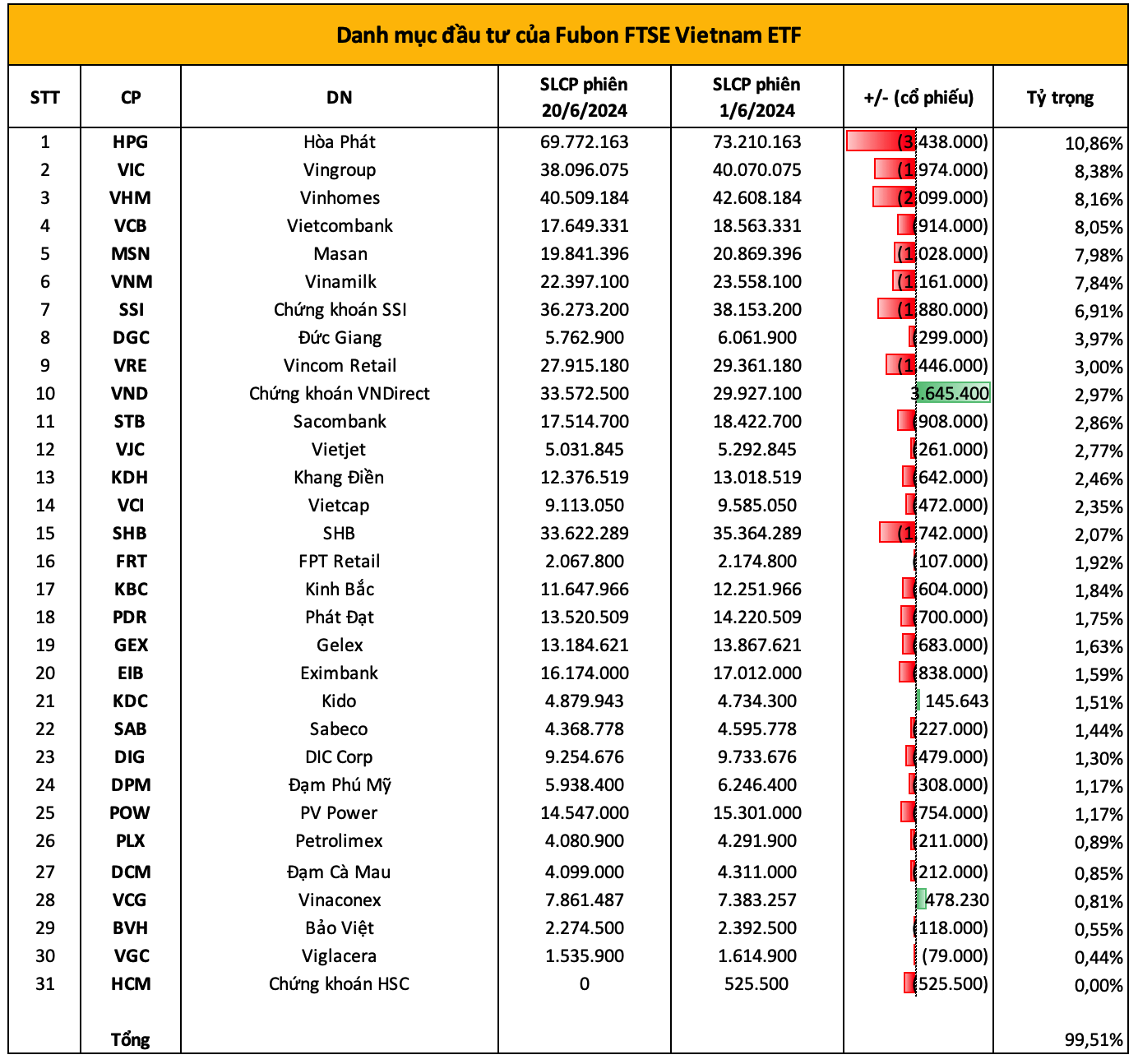

In terms of selling volume, Fubon ETF sold most of the stocks in the portfolio, specifically net selling more than 3.4 million HPG shares, 1.9 million SSI shares, 2.1 million VHM shares, 2 million VIC shares, 1.7 million SHB shares, 1.2 million VNM shares...

In particular, the foreign fund sold all 525 thousand HCM shares, removed them from the portfolio, reducing the number of shares held by the foreign fund to 30 shares.

Previously, in the first quarter 2024 portfolio restructuring period at the end of March, in addition to adding two new stocks, FRT of FPT Retail and EIB of Eximbank, to the portfolio, the FTSE Vietnam 30 Index (Fubon ETF reference) removed HCM. However, the Fubon ETF fund still held HCM stocks with a low proportion until the June 18 session when it was officially sold.

On the other hand, Fubon ETF bought VND strongly with more than 3.6 million shares, increasing the proportion to 2,97%, equivalent to holding nearly 34 million shares. At the same time, the fund also net bought more than 478 thousand VCG shares and nearly 146 thousand KDC shares.

With strong net selling momentum, cash flow into this ETF from the beginning of 2024 recorded a net withdrawal of 101 million USD, equivalent to about 2,500 billion VND.

Latest information, the Financial Supervisory and Management Commission has officially approved the additional capital mobilization amount of the 6th round of Fubon FTSE Vietnam ETF at 5 billion TWD (~154 million USD). Thus, Fubon ETF is likely to invest up to 4,000 billion VND to buy Vietnamese stocks in the near future.

Source: CafeF