Since the beginning of 2024, this stock has increased by 64% in value, bringing the company's market capitalization close to the threshold of 11,400 billion VND.

The recent period has witnessed a strong rise of the "Viettel family" group of stocks. In particular, VTP shares of Viettel Post Corporation (Viettel Post) continued to make a strong impression when they accelerated to the ceiling price of VND93,400/share in the session on June 19, aiming to surpass the historical peak of VND94,100/share just set in mid-March 2024.

Even at the ceiling price, this stock is still "sold out", with nearly 68,000 units remaining to buy at the end of the day. Along with that, trading at VTP is relatively active with a matched volume of nearly 3.7 million units, equivalent to a trading value of more than 330 billion VND. This is the second highest liquidity of VTP since this stock was listed on the stock exchange.

In the past 2 months, VTP's market price has accelerated by 37% to reach the old peak. If we look at the broader picture from the beginning of 2024, this Viettel stock has increased by 64% in value, bringing the market capitalization of the "giant" in the delivery service industry to nearly 11,400 billion VND.

Viettel Post has a charter capital of nearly 1,218 billion VND, is a member of the Military Industry - Telecommunications Group (Viettel). Viettel Post's logistics ecosystem is based on a modern, high-tech infrastructure platform, providing full services such as: delivery, supply chain (warehousing, transportation, forwarding ...), cross-border e-commerce ...

Viettel Post listed its shares on UPCoM on November 23, 2018, with a valuation of nearly VND3,000 billion. After more than 5 years, VTP officially listed on HoSE on March 12, 2024, with a reference price of VND65,400/share.

Regarding the business situation, in 2024, Viettel Post set a revenue target of VND 13,847 billion, down VND 291 billion compared to the actual level in 2023, but profit after tax is expected to increase slightly to VND 384 billion. The company aims to increase revenue 10 times over the next 5 years compared to 2023, equivalent to a growth rate of VND 60-651 billion per year for both core activities and new areas.

Viettel Post's Board of Directors aims to increase its revenue 10 times over 2023 in the next 5 years, equivalent to a growth rate of 60-65% per year for both core operations and new areas. Pioneering logistics technology in Vietnam gives Viettel Post a better competitive advantage. This facilitates Viettel Post to take the next step of "Going Global" to expand cross-border logistics infrastructure, making Vietnam a regional and global logistics center.

After the first quarter of the year, Viettel Post recorded revenue of nearly VND 4,700 billion, of which delivery revenue reached VND 1,853.2 billion, an increase of VND 54% over the same period last year; revenue from the logistics segment reached VND 222.8 billion, an increase of VND 32% over the first quarter of 2023. As a result, profit after tax in the first quarter reached VND 58 billion, a decrease of VND 23% over the same period and completed the annual profit target of VND 16%.

Long-term potential thanks to leading position in logistics

According to a recent analysis report, Shinhan Vietnam Securities stated that VTP's service coverage reaches 0.12 km/service point, higher than the industry average of 2.9 km/service point. This brings advantages in terms of operating range and superiority in the inter-provincial delivery market.

According to Shinhan Securities, Viettel Post is investing heavily in infrastructure and technology networks, including smart warehouses, network operations (NOC), and process automation. Viettel Post is also the first logistics company in Vietnam to deploy AGV robot technology, thereby increasing the level of automation in the sorting and picking process. Investment in infrastructure and technology is the key to sustainable development.

In addition, promoting fulfillment (order completion service, including operations from the time goods are placed in the warehouse until customers receive the goods) and expanding the supply chain are growth levers for this delivery business. In particular, technology and large warehouses are VTP's strengths.

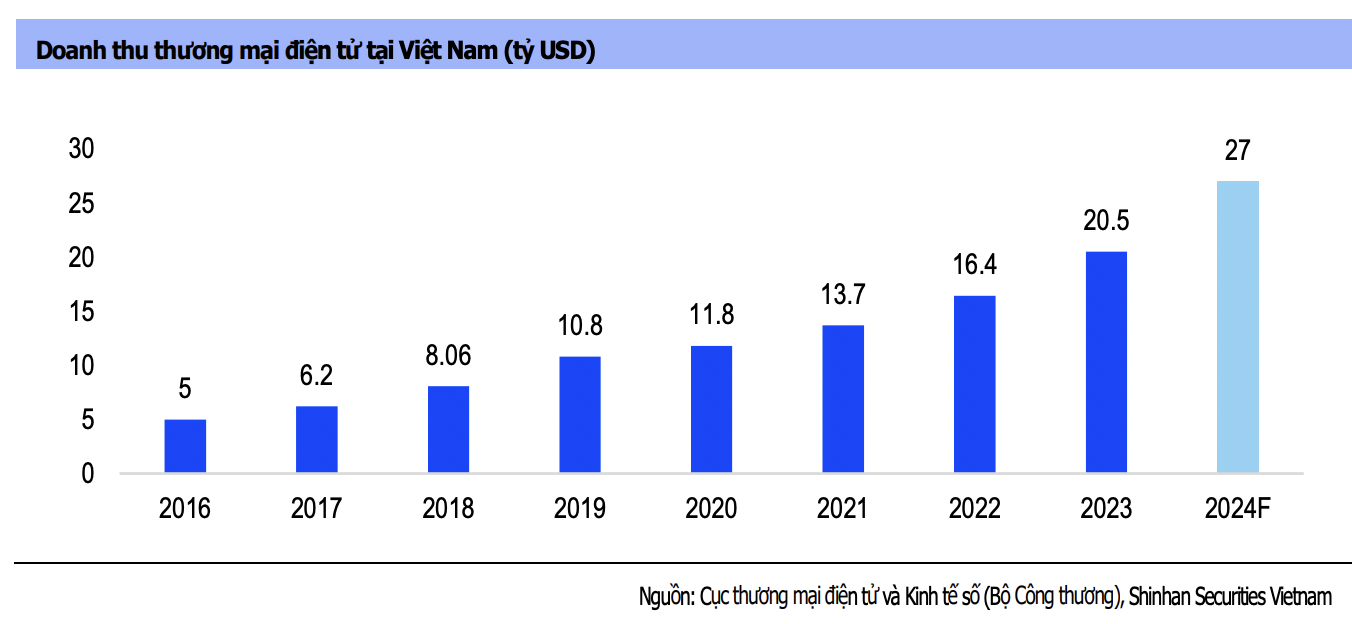

In particular, the Vietnamese e-commerce market is valued at 15 billion USD and is expected to grow at a CAGR of 28%/year, reaching an estimated size of 52 billion USD by 2025. The booming e-commerce platform will play a key role in the future development of Viettel Post.

An Binh Securities (ABS Research) also expects VTP's 2024 business results to continue to maintain the growth momentum of previous years, with the main driving force being to boost business in domestic and international markets in core business segments (expanding warehouse systems, developing infrastructure to improve transportation capacity, strongly applying AI technology, participating in the delivery sector in international areas such as Myanmar, Cambodia and cooperating with other partners in Australia, China, etc.).

In the long term, ABS Research believes in the long-term potential thanks to its leading position in the logistics sector in Vietnam and its gradual integration into the international market. In the period of 2024 - 2025, the company plans to spend about 3,000 billion VND to expand warehouse infrastructure and invest in sorting systems. In the future, Viettel Post is expected to open more delivery companies in Laos and representative offices in Thailand, China, etc. Although 95%'s revenue comes from the domestic market, ABS believes that foreign markets are new and large sources of growth in the period of 2025-2030.

Source: CafeF