Before the announcement that it would cease operations, Vietnamese stocks regularly accounted for the highest proportion in this ETF's portfolio.

BlackRock has announced the liquidation of the iShares MSCI Frontier and Select EM ETF after 12 years of operation, according to MorningStar. Accordingly, BlackRock expects the ETF to cease trading and no longer accept creation and redemption orders after the market closes on March 31, 2025. However, the announcement also emphasized that this date is subject to change.

During the extended liquidation period, the iShares MSCI Frontier and Select EM ETF will no longer be managed in accordance with its investment objective and policies as the fund will sell off its assets, BlackRock said. Proceeds from the liquidation are expected to be distributed to shareholders approximately three days after the last trading day, according to BlackRock.

iShares MSCI Frontier and Select EM ETF is an ETF that specializes in investing in frontier and emerging markets, formerly known as Ishare MSCI Frontier Markets 100 ETF with the reference index being MSCI FM 100 Index. In March 2021, the fund changed its name to iShares MSCI Frontier and Select EM ETF as it is now and uses the MSCI Frontier & Emerging Markets Select Index as a reference.

As of June 10, the total net asset value of iShares Frontier and Select EM ETFs is up to 425.6 million USD (~10,300 billion VND). Of which, Vietnamese stocks only account for 18%, equivalent to about 76 million USD (~1,900 billion VND).

Prior to the surprise announcement, Vietnam had consistently been the market with the highest weighting in the iShares MSCI Frontier and Select EM ETF portfolio. At the end of Q1/2024, the weighting of Vietnamese stocks accounted for 28.5% of the fund's NAV.

Notably, amid the recent wave of capital withdrawals from frontier and emerging markets, iShares MSCI Frontier and Select EM ETF unexpectedly attracted a net inflow of nearly 38 million USD (~900 billion VND) since the beginning of 2024. In the previous year of 2023, this ETF had a net withdrawal of more than 97 million USD (~2,300 billion VND).

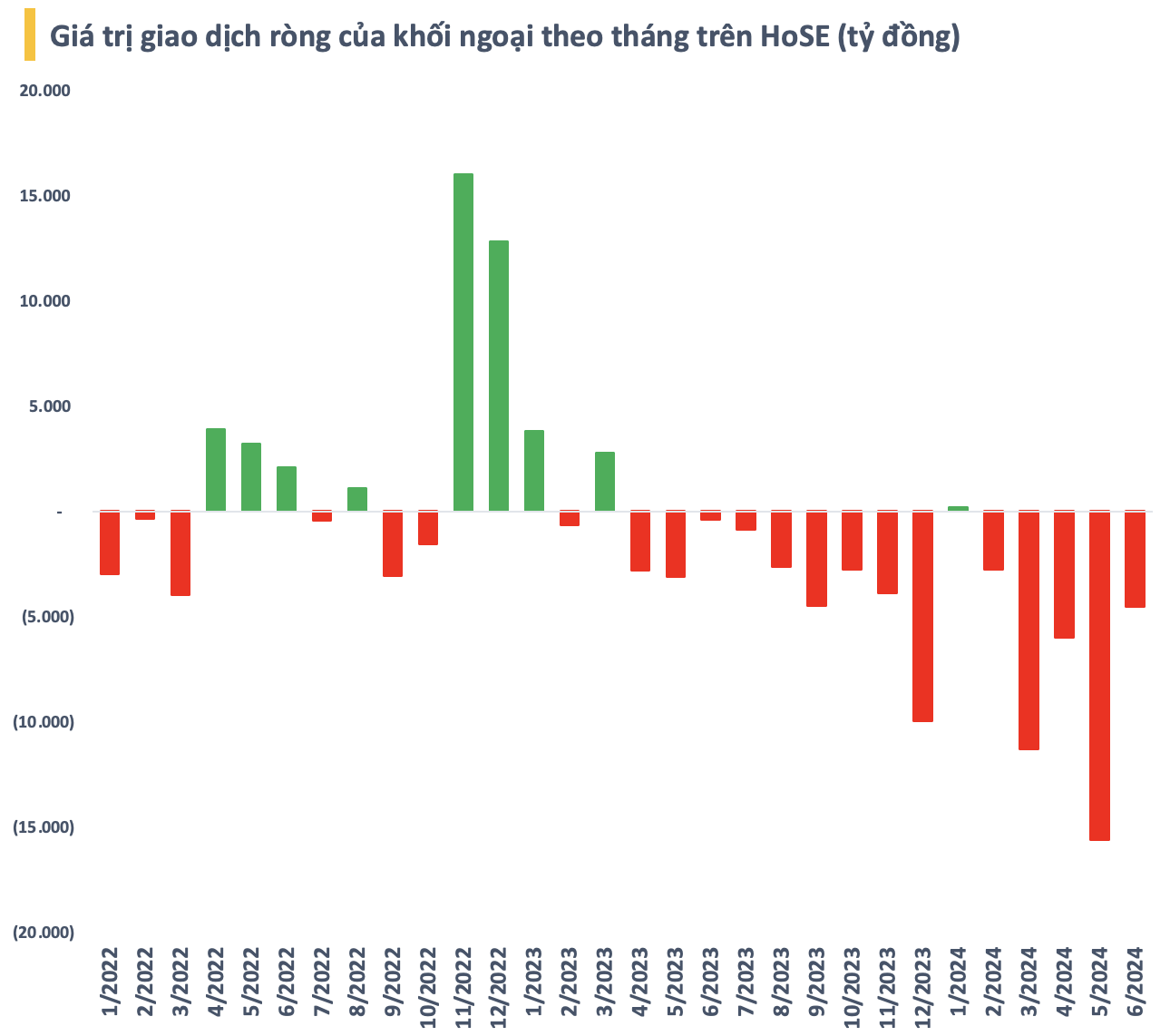

Meanwhile, the Vietnamese stock market is continuously suffering from strong net selling from foreign investors. From April 2023 to now, foreign investors have only "taken a break" in January 2024. Accumulated from the beginning of 2024, the total net selling value of foreign investors on HoSE has reached nearly 40,000 billion VND.

According to SGI Capital, the persistent net selling by foreign investors may come from concerns about exchange rate risks when the VND interest rate is lower than the world, divestment of some groups of stocks with high local risks, and the impact of the general net withdrawal trend from emerging markets... This investment fund believes that this trend currently shows no signs of ending or reversing.

Source: CafeF