Money returned to the US market in May (+42.3 billion USD) thanks to the push from individual investors and the explosion of small stocks (meme stocks), in addition to the Technology group. In the first 5 months of the year, developed market stock funds recorded a net inflow of 127.1 billion USD.

While ETF capital in general and foreign capital in particular withdrew from the Vietnamese market and Southeast Asian markets, emerging markets recorded a sharp increase in net inflows. In the first 5 months of the year, developed market equity funds recorded a net inflow of 127.1 billion USD, according to SSI Research.

CASH FLOW INTO DEVELOPED MARKET EQUITY FUNDS

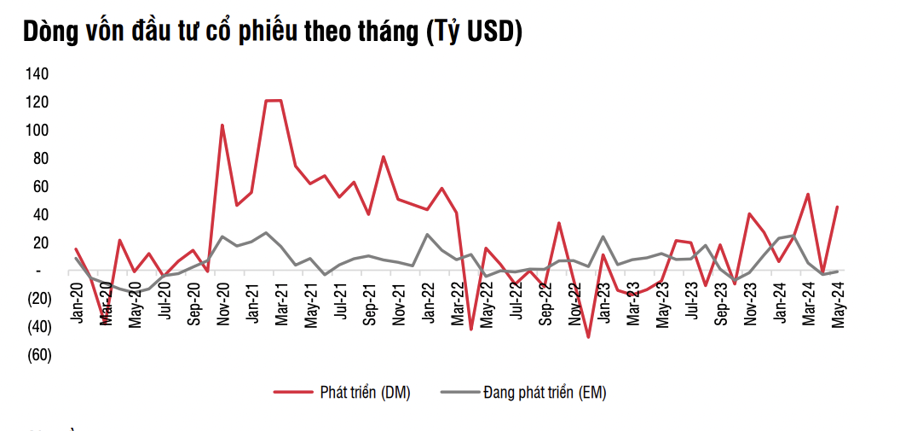

Global equity funds reversed net inflows in May. After a cautious period in April, cash flows into equity funds were more active throughout May thanks to positive business results of listed companies, especially technology groups, and momentum from personal cash flows.

Specifically, global equity funds net inflowed 44.2 billion USD, of which developed markets reached 45.2 billion USD. In the first 5 months of the year, equity funds net inflowed 175.7 billion USD.

Bond funds saw net inflows for the 17th consecutive month, with a slight increase in intensity (52.9 billion USD, up 26% compared to the previous month). The high interest rate environment helped maintain the attraction of developed market bond funds with a disbursement of 54.1 billion USD. In the first 5 months of the year, bond funds attracted 252 billion USD.

Money market funds saw a strong reversal in net inflows in May. Money market funds rebounded and net inflows were $84.7 billion. Thus, except for the net withdrawals in March and April due to the seasonal impact of the peak tax settlement season, the attraction of money market funds has remained since September 2022. In the first 5 months of the year, money market funds had a net inflow of $169.7 billion.

Developed Market Equity Funds (DM) posted strong net inflows of $45.2 billion. Money returned to the US market in May (+$42.3 billion) thanks to retail investors and a boom in meme stocks, in addition to Technology. In the first 5 months of the year, developed market equity funds recorded net inflows of $127.1 billion.

Capital flows into emerging market (EM) stocks were down $1 billion, with Asia (excluding Japan) posting a net outflow of $464 million. China recorded a negative performance (-$4.4 billion), mainly due to the withdrawal of capital from multinational ETFs. In contrast, the Indian market attracted a large amount of capital inflows in May (+$2.6 billion) ahead of the election results. Other markets were not very prominent (except Taiwan (+$1.9 billion thanks to capital flows into domestic ETFs). Notably, Southeast Asia continued to record a net outflow for the fifth consecutive month with a value of $203 million.

Short-term flows to equity funds are more positive thanks to the monetary policy effect when some major Central Banks in the world will cut interest rates and the motivation from individual investors. However, the survey from BofA shows a significant level of caution from investment funds when considering disbursing into the US market.

The historical trend of cash flows into the US stock market before the election period has not been very positive (except in 2004). Another point worth noting is that the BofA survey showed that the cash ratio in May was 4.0% – lower than 4.2% in April and at the “reversal risk” level (below 4%).

CAPITAL WITHDRAWAL IN VIETNAM SLOWS DOWN

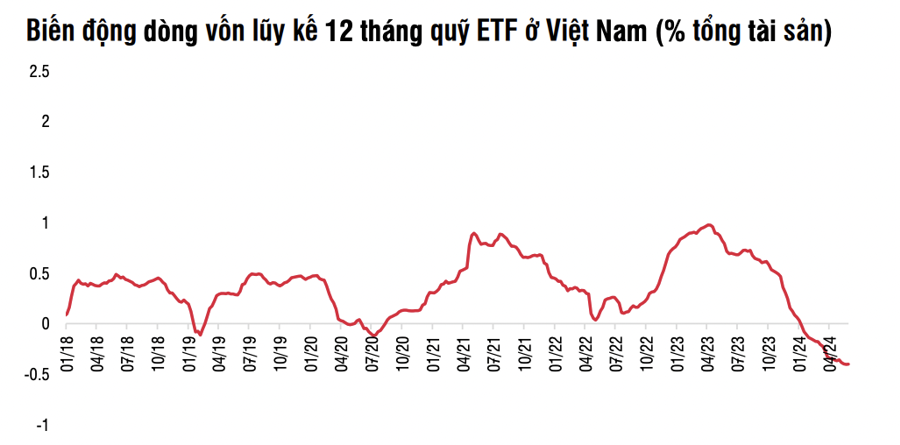

In the Vietnamese market, ETF funds continued to withdraw capital in May, however, the net withdrawal value decreased significantly compared to the previous two months, recorded at -1.8 trillion VND, equivalent to about 2.6% of total fund assets.

Since the beginning of the year, ETFs have withdrawn a total of VND12.38 trillion, equivalent to -16.31 trillion in total fund assets by the end of 2023. Funds under the strongest capital withdrawal pressure include DCVFM VN30 (-6.4 trillion), SSIAM VNFIN Lead (-1.7 trillion), DCVFM VN30 (-1.5 trillion) and Fubon (-1.5 trillion).

The net withdrawal momentum slowed down mainly due to the DCVFM VNDiamond fund slowing down its net withdrawal rate (-270 billion in May) or the iShares Frontier fund temporarily stopping capital withdrawals and the Xtrackers FTSE fund also reversing from a net withdrawal of -408 billion VND in April to a net inflow of +183 billion VND in May. The KIM Growth VN30 fund continued to record positive net capital inflows with a value of +310 billion in the month.

On the contrary, funds DCVFM VN30 (-564 billion), SSIAM VNFIN Lead (-676 billion), and Fubon (-773 billion) continued to face strong capital withdrawal pressure in May.

SSI Research maintains a cautious view on capital flows into Vietnam's ETFs, however, the net withdrawal intensity will be more limited than in Q2. Positive signals may begin to appear when the macro environment (exchange rate and interest rate) or political fluctuations become more stable. In particular, Vietnam may benefit when the trend of profit-taking and seeking other investment opportunities appears in the Taiwanese market.

Active funds have quite a divergence between funds investing only in Vietnam and multinational investment funds. Funds investing only in Vietnam have slightly withdrawn about 50 billion VND net and it is worth noting that some funds have slightly increased net inflows in May and multinational investment funds continue to withdraw strongly in May.

In total, cash withdrawals were about VND 1,500 billion in May, bringing the total net withdrawals in the first 5 months of the year to more than VND 5.5 trillion, accounting for about VND 1.21 trillion of the Fund's total assets.

One notable point is that foreign investors increased their net selling in May with a total volume of up to 19 trillion VND, concentrated in the banking and real estate groups. The difference between investment capital flow and foreign transactions comes from the following two main reasons: active funds have only restructured their portfolios but have not withdrawn capital from Vietnam and statistics are delayed (such as the period of Q2 and Q3/2023).

Interest rate, exchange rate and political risks are the biggest factors affecting capital flows into Vietnam at the present stage. On the positive side, the expectation is that the second draft of the circular allowing securities companies to implement payment support for institutional investors will be announced soon.

Source: VnEconomy