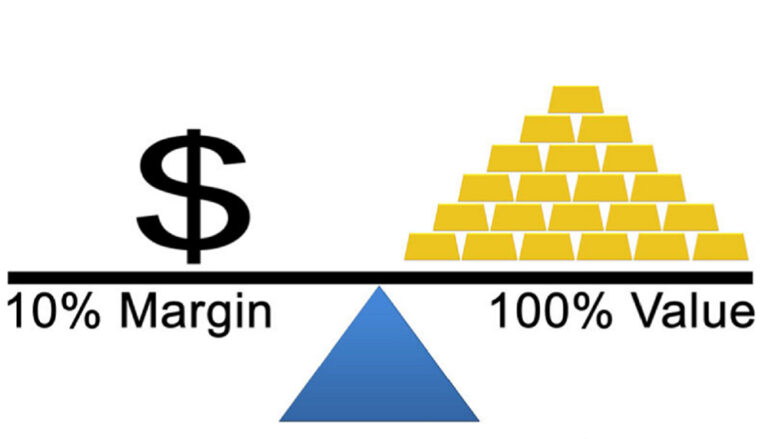

What is the term Margin? In securities, it means that investors mortgage the stocks they buy to borrow money to buy more stocks, increasing profits. However, not everyone knows how to calculate and use Margin loans to get the most benefit.

1. What is margin?

What is margin? is a familiar question in the field of stock investment. Margin, or Margin Trading, is a powerful tool for investors in the stock world. It allows investors to borrow money from securities companies to buy stocks or other assets, without using all of their own capital. However, using Margin also comes with risks. Therefore, to effectively utilize Margin, investors need to have a solid understanding of the market and the ability to manage risks. At the same time, abusing Margin can lead to negative consequences. Therefore, the use of Margin should be approached carefully and only when the market is stable enough and investors have enough experience to control risks.

>>> See more articles: FIND OUT THE TOP 10 WORLD STOCK EXCHANGES

Due to overuse Margin will lead to many consequences, so investors should only use Margin when satisfying the following requirements:

– When you have market experience, understand how to read charts and technical analysis, understand market mechanisms and trends.

– When the market shows signs of stable and clear growth.

– Margin should only be used in short-term transactions. Using it for long-term transactions will have many potential risks while the efficiency is not high.

Formula for calculating Margin loan ratio

M = (V – L) / V = Investor's net worth / Total value of securities

In there:

- M: Margin ratio/deposit ratio.

- V: Total value of securities calculated at market price.

- L: Total loan value including principal and interest.

For example: An investor only has 2 billion but can invest up to 4 billion, then the margin ratio is 1:2. In fact, some securities companies that circumvent the law can lend at a ratio of 1:3 or 1:4.

Currently, the State Securities Commission also allows the purchase of the best stocks on the market with a loan ratio of 50% (leverage ratio of 1:2). However, some securities companies circumvent the law by lending up to 1:3 or 1:4 for good stocks that the securities company believes can control the risk.

2. What is the role of Margin in stock investment?

Using Margin The biggest benefit for investors is the ability to optimize personal resources. When using Margin, investors can buy more stocks based on the number of stocks they already own. When the stock price increases, profits also increase, increasing the net asset value, from which investors can buy more stocks to increase profits.

>>> See more articles: What is sideway indicator and trading opportunities in the market

However, if the stock price falls, the investor's net worth will also decrease rapidly, corresponding to the leverage ratio they use. For example, if the investor uses a leverage ratio of 1:2, they will lose twice the normal loss.

When the net asset value decreases, the securities company will require investors to add more collateral. If they do not do so, they will have to sell some shares to reduce the loan, ensuring compliance with the prescribed leverage ratio.

Margin plays an important role in stock investment because it allows investors to take advantage of investment opportunities without using all of their own capital. Thanks to this feature, investors can borrow money from the exchange to buy stocks or other assets. Using Margin helps to optimize available capital, thereby increasing profitability and expanding their investment scope. However, using Margin also comes with high risks and requires a solid understanding of the market and financial capacity to manage risks effectively.

3. What are the regulations on Margin lending?

To conduct margin securities transactions, investors need to understand the regulations on margin loanBelow are the basic regulations on Margin lending that investors need to comply with:

- Loan conditions: Securities companies provide Margin lending services with specific conditions. Investors need to comply with these conditions to be able to borrow capital to participate in the stock market.

- Initial and maintenance margin ratio: Investors must maintain the initial margin ratio and maintenance margin ratio according to the contract signed with the securities company. This ensures stability and safety for both investors and the company.

- Notification when service is not available: If a securities company is no longer qualified to provide margin lending services, they must stop signing new contracts, renew contracts and report to the State Securities Commission within 48 hours. This Commission has the authority to temporarily suspend margin lending transactions at that company to stabilize the market.

Margin, although it can help investors increase profits quickly when stock prices increase, also carries the risk of assets quickly "evaporating" when stock prices decrease. This is like a double-edged sword, only suitable for experienced investors who are willing to accept risks. Newbies, those with little experience and are not familiar with the market should not use Margin.

Margin should only be used when the market shows clear signs of growth, not when the market is unclear. Margin should only be applied in short-term trading and choose stocks with good liquidity.

Margin is a tool to expand positions and increase investment performance, but it can also cause investors to burn their accounts and receive Margin calls. If you intend to borrow Margin, you need to always monitor the market, choose the appropriate leverage ratio and only invest in stocks with potential to increase in price.

4. Concepts related to Securities Margin

>>> See more articles: OPPORTUNITIES AND RISKS IN EX-DIVIDENTIAL TRADING DAY

Concepts related to Margin include Call Margin and full Margin – these are very important concepts related to margin operations that you need to know.

Full Margin – Maximum Margin: Full Margin is a state when investors use the maximum margin ratio to buy stocks. The maximum margin lending ratio – Full Margin is regulated by regulatory agencies such as the Vietnam Securities Commission, usually 1:2.

For example: If you have 20 million VND and use Margin at a ratio of 1:2, you can buy stocks worth up to 40 million VND.

Call Margin – Margin Call: Margin Call is a request from the securities company to request the customer to deposit more money or increase the amount of collateral securities to keep the Margin loan ratio at a safe level. Investors will receive a Margin Call when the ratio of "Net Asset Value/Securities Value" is less than the prescribed margin ratio.

For example: If the maintenance margin ratio is 40% and your net worth falls below this level, the brokerage firm may require you to deposit additional funds or increase the number of shares pledged.

Margin Level – Margin Limit: Margin Level is the maximum amount an investor can borrow from a brokerage firm when opening a margin account. This is the maximum amount an investor can use to make a margin loan transaction.

5. Impact of Margin on investors

Margin is used by many investors as a leverage to increase profits, but it also comes with a high level of risk. Therefore, careful monitoring of the market is necessary when using Margin.

When stock prices rise, the market tends to rise and so does the investor’s net worth. In this situation, investors will often buy more shares to increase their profits quickly.

However, when the stock price falls, net worth The investor's margin also decreases in proportion to the leverage ratio. If the margin ratio is 1:1, you will lose an amount of money equivalent to the value of the shares purchased. If the ratio is 1:2, you will lose twice as much.

These are two common situations when using Margin leverage. In the second case, when you experience a loss, what you need to do is sell some stocks or add more money to your Margin account to avoid being called for additional assets.

Source: Onstocks