BitMine Continues to “Collect” Ethereum at an Incredibly Fast Rate

In just one week, BitMine Immersion – a well-known investment firm in the cryptocurrency industry – bought another $1 billion worth of Ethereum (ETH), bringing its total ETH holdings to 566,776 ETH, worth about $2 billion.

Notably, BitMine reached this milestone in just 16 days since launching its Ethereum accumulation strategy with an initial capital of $250 million. With this move, BitMine has officially reclaimed the title of the largest public company holding ETH from SharpLink Gaming, which also bought another $250 million in ETH last week.

Mr. Thomas Lee – Chairman of the Board of Directors of BitMine and veteran investor from Fundstrat – emphasized:

“BitMine has crossed $2B ETH in just 16 days. Our long-term goal is to hold 5% of total ETH supply and stake all of these assets to maximize profits.”

Strong backing from Wall Street giants

At the same time as the ETH accumulation data was announced, BitMine’s BMNR shares were listed on the New York Stock Exchange for options trading. The famous investment fund ARK Invest immediately poured in $182 million, while billionaire Peter Thiel’s Founders Fund is also said to be one of the “big guys” backing BitMine.

Still, BMNR shares are trading around $40, well below their peak of $135 in early July.

Institutional Trends in Ethereum

According to statistics, Ethereum is attracting huge inflows from traditional financial institutions. In addition to BitMine, names such as SharpLink Gaming, Ether Machine, Bit Digital, BTCS, GameSquare, and ETH ETFs are all joining the accumulation race. Last week alone, inflows into Ethereum ETFs hit a record $2.1 billion.

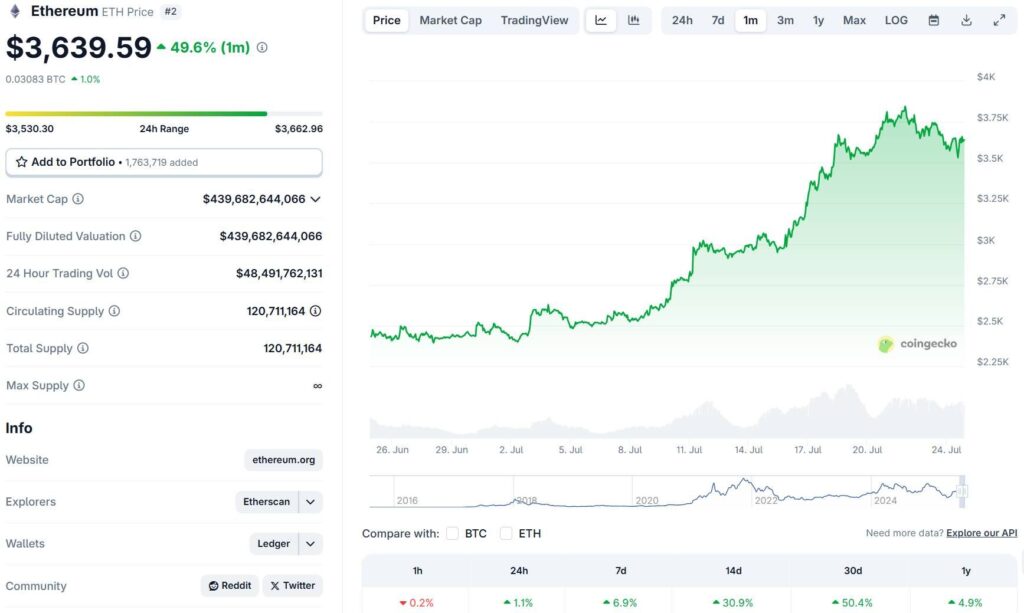

This surge has helped ETH price increase by more than 60% over the past month, at one point reaching a 7-month high of $3,800 before correcting to $3,600.

The July 24, 2025 milestone also marks one year since Ethereum ETFs began trading, with total assets reaching $18.3 billion. Notably, BlackRock’s ETHA fund now holds $10 billion, making it the third fastest ETF to reach the $10 billion mark in history, behind only BlackRock and Fidelity’s Bitcoin ETFs.

The continued investment in Ethereum by major institutions like BitMine not only shows strong confidence in the long-term value of ETH, but also opens up huge opportunities for pioneering technology businesses.