Playing the stock market is not as easy as many people think. Besides the element of luck, understanding the market, analytical data or being completely rational, a successful good investor cannot lack the ability to control his emotions.

We are not as rational as we think.

Humans have always believed that they are rational creatures. But this belief was denied by behavioral economist Dan Ariely in his famous psychology book “Irrational”.

You know that a newspaper is a tabloid, but the next day you gossip about a scandalous singer that was published in the newspaper as if it had some truth to it. You claim that you never believe in advertising, but you still buy products that are advertised daily on TV and in the newspaper. When a rumor, no matter how wild, is repeated enough times, you begin to believe it is true.

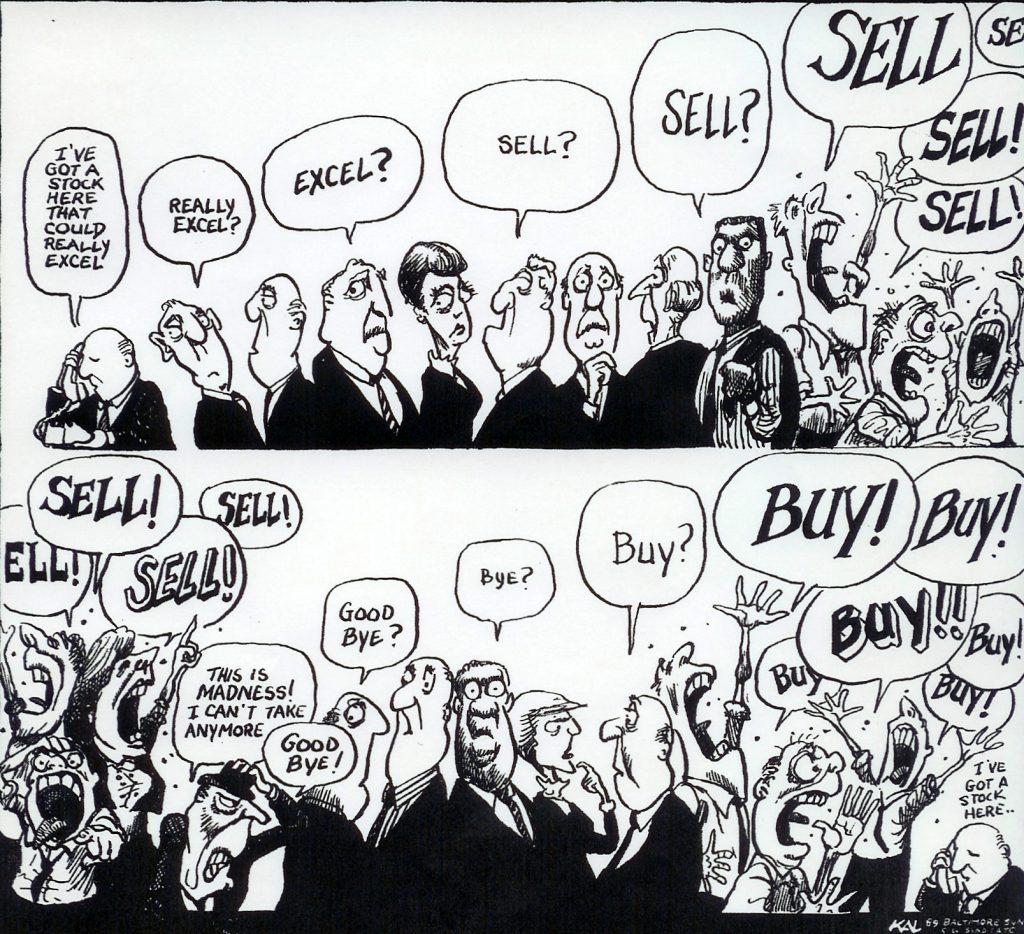

One of the very familiar advices when participating in the stock market that you must have heard from the early days is to control your emotions, stay calm, and not be too hasty and worried when there are fluctuations. But if the price of the stocks you are holding in large quantities plummets, the company's leaders have extremely bad news, or the business's industry is at a great disadvantage, can you not panic and find a way to sell off?

There is a stock code that suddenly increases in price very fast in the market and everyone is rushing to buy it. Can you completely not flinch and think about running to join the long line of people? Are you sure that you are never affected by the confusing information in the market?

Although many people know that the majority is not always right, they still unconsciously follow the crowd due to fear for their assets.

The market is not as reliable as we think

We are very easily influenced by the market. But if the market were a girl, she would be a very capricious princess, very erratic and more changeable than the weather.

News and market waves always come and go at the same speed as stock prices go up and down. Waves of selling and buying are no longer strange events for those who have lived long in the stock market. In addition, there will always be "big guys" who always find ways to give fake information or create market trends to benefit themselves. Bull traps and bear traps still appear frequently, fooling many people even when they have been fooled dozens of times before. Because crowd psychology is instinctive, you will always be somehow affected by market trends in your trading decisions.

But the most successful investors don't.

Warren Buffett, Benjamin Graham, Peter Lynch,… are never affected by information and trends in the market. They are people who pursue long-term value investing methods for many years, while the information that their competitors in the market care about and spend time discussing only lasts a few days.

“He doesn’t look at the flashy investments and he doesn’t follow the market trends. He looks at the sensible investments.” – that’s what Buffett said about Graham and what he has always followed throughout his illustrious career.

Of course, this advice does not apply to market swing traders who just want to make a profit in a few short months.

“Be greedy when others are fearful. And be fearful when others are greedy” – Warren Buffet

Carefully consider, clearly analyze the situation as well as have your own opinion is advice for all areas of life, not just stock investment. There is no equal victory for all investors in the market, you need to have your own strategy and belief instead of using the belief of others, because it is very likely that the money will belong to someone else.

If what you are after is long-term returns over the next 1 year, 5 years or even 10 years, why should you care about the stock value today, tomorrow or next week?

Playing the stock market also requires keeping a cool head, calmness, and steadfastness like when playing a game of poker. And absolutely do not let the surrounding influences affect the core strategy you pursue throughout the game. To win against an unpredictable opponent like the market, a good investor needs 3 factors: first is steadfastness, second is steadfastness, and third is really steadfastness.